Europe Quantum Communication Market Share & Analysis, 2034

Europe Quantum Communication Market Report Summary

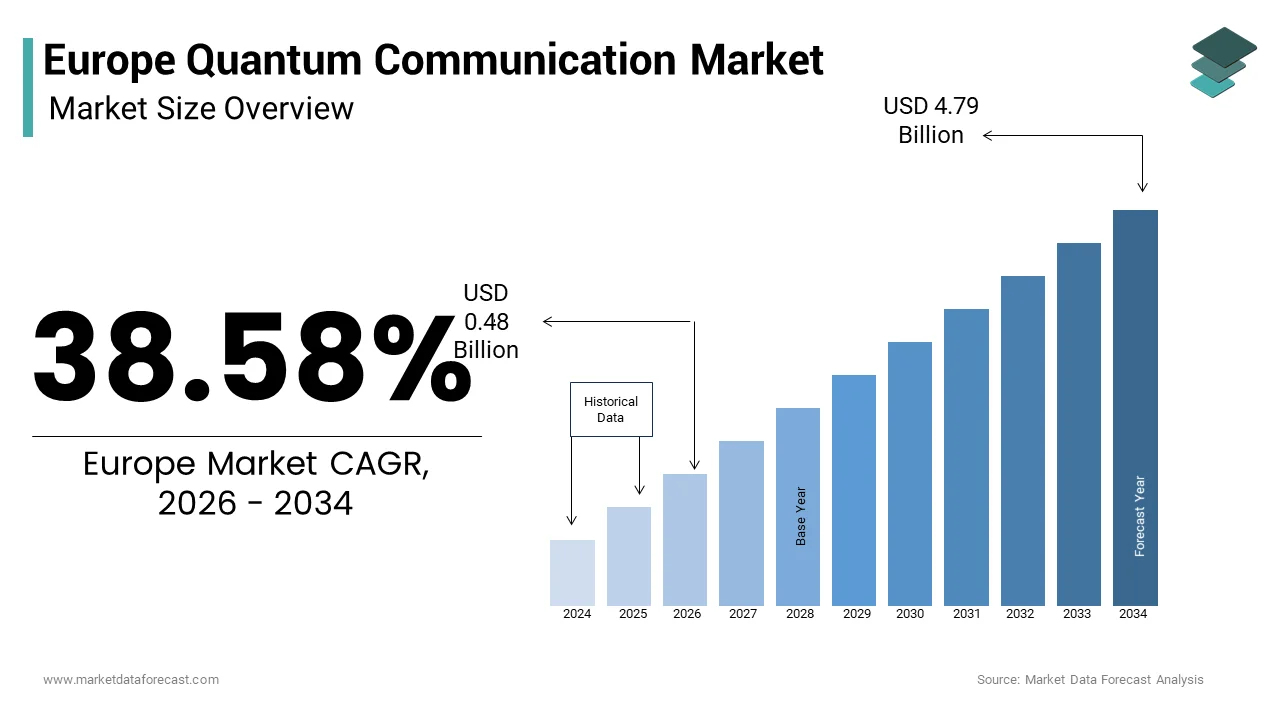

The European quantum communication market was valued at USD 0.34 billion in 2025 and is projected to grow from USD 0.48 billion in 2026 to USD 4.79 billion by 2034, registering a remarkable CAGR of 38.58% during the forecast period (2026–2034).

Market growth is primarily driven by increasing cybersecurity threats, rising investments in quantum-safe encryption, and strong government-backed quantum technology initiatives across Europe. The expansion of quantum key distribution (QKD) networks, the development of secure communication infrastructure, and collaboration between research institutions and defense agencies are significantly accelerating market adoption.

The growing emphasis on protecting critical infrastructure, financial systems, and defense communications from future quantum-enabled cyberattacks is further strengthening demand for advanced quantum communication solutions.

Key Market Trends

- Rapid deployment of quantum key distribution (QKD) networks across Europe to enhance secure data transmission.

- Increasing public and private investments in quantum-safe cybersecurity infrastructure.

- Strong government and EU-level initiatives supporting quantum research and cross-border quantum communication corridors.

- Integration of quantum communication with satellite-based secure networks.

- Rising collaborations between telecom providers, defense organizations, and quantum technology startups.

Segmental Insights

By Transmission Medium

The fiber-based quantum key distribution (QKD) segment dominated the market, holding 85.5% of the regional market share in 2025. Its leadership is attributed to the established fiber-optic infrastructure across Europe, enabling cost-effective and scalable deployment of secure quantum communication networks.

By Offering

The solutions segment led the market by capturing 71.6% of the European market share in 2025. The dominance of this segment stems from the growing demand for integrated quantum encryption systems, secure communication platforms, and customized quantum security architectures for critical industries.

By Vertical

The government and defense sector accounted for the largest share of 60.3% in 2025. Increasing concerns over national security, confidential data protection, and strategic communication systems are driving early adoption of quantum communication technologies within defense and public sector institutions.

Regional Insights

- Germany held the leading position in the European quantum communication market, accounting for 25.5% of the regional share in 2025. The country’s dominance is supported by strong research funding, advanced industrial infrastructure, and active participation in EU quantum initiatives.

- France represented 18.3% of the market share in 2025, driven by national quantum strategies and investments in secure communication systems.

- The United Kingdom is projected to register a promising CAGR during the forecast period, supported by robust innovation ecosystems and quantum research programs.

- Switzerland is expected to account for a notable market share, benefiting from its advanced quantum research institutions and strong presence of quantum technology firms.

- The Netherlands is anticipated to witness healthy growth due to increasing digital security investments and collaborative quantum research projects.

Competitive Landscape

The European quantum communication market is highly innovation-driven, characterized by strong participation from global quantum technology companies and cybersecurity specialists. Market players are focusing on expanding QKD networks, developing quantum-resistant encryption solutions, and forming strategic partnerships with telecom operators and government agencies.

Prominent companies operating in the European quantum communication market include ID Quantique SA, Thales Group S.A., IDEMIA SAS, QuintessenceLabs Pty Ltd., QuantumCTek Co., Ltd., QNu Labs Pvt. Ltd., Quantum Xchange, Inc., MagiQ Technologies, Inc., and Aliro Technologies, Inc.

Europe Quantum Communication Market Size

The Europe quantum communication market size was valued at USD 0.34 billion in 2025 and is anticipated to reach USD 0.48 billion in 2026 to USD 4.79 billion by 2034, growing at a CAGR of 38.58% during the forecast period from 2026 to 2034.

Quantum communication includes technologies that leverage quantum mechanical principles that are primarily quantum key distribution (QKD) and quantum entanglement to enable theoretically unhackable secure data transmission. Unlike classical encryption, which relies on computational complexity, quantum communication derives security from the laws of physics, where any eavesdropping attempt inevitably disturbs the quantum state and is detectable. The European Union has positioned quantum communication as a strategic pillar of digital sovereignty under the EuroQCI initiative, which aims to deploy a secure quantum communication infrastructure spanning all 27 member states by 2027. As per the European Commission, operational QKD networks already connect government facilities in Germany, France, Italy, and Spain, which is covering extensive terrestrial fiber routes. The European Space Agency’s SAGA mission plans to launch a quantum key distribution satellite by 2026 to enable intercontinental secure links. As per ENISA, cyber threats targeting critical infrastructure have been increasing, which is heightening demand for quantum resistant solutions. As per Eurostat, a significant portion of EU citizens possessed only basic digital skills, underscoring the need for automated, tamper proof security layers that do not rely on human protocol adherence. These converging technological, geopolitical, and regulatory forces define Europe’s urgent pursuit of quantum-secured communications.

MARKET DRIVERS

Escalating Cybersecurity Threats to Critical Infrastructure

European critical infrastructure faces unprecedented cyber threats that conventional encryption cannot reliably mitigate, which is driving urgent adoption of quantum communication solutions and is one of the major factors propelling the growth of the European quantum communication market. As per ENISA, attacks targeting energy grids, financial systems, and healthcare networks have been increasing, with ransomware groups employing AI to accelerate vulnerability exploitation. The European Union Agency for Cybersecurity emphasizes that current public key cryptography will be rendered obsolete by quantum computers within the next decade, creating a harvest now decrypt later risk where adversaries collect encrypted data today for future decryption. In response, the EU’s NIS2 Directive mandates enhanced security measures for essential entities, with quantum key distribution emerging as a compliant solution for high value data channels. Germany’s Federal Office for Information Security already protects its parliamentary communications using a 1,200-kilometer QKD backbone linking Berlin, Bonn, and Munich. Similarly, the French National Cybersecurity Agency deployed QKD to secure electricity grid control signals across EDF’s nuclear facilities, preventing potential sabotage through undetectable data manipulation.

EU Strategic Autonomy and the EuroQCI Initiative

The European Commission’s EuroQCI initiative represents a coordinated continental effort to establish sovereign quantum secure communications independent of non-EU technology providers, which is further boosting the expansion of the European quantum communication market. Launched in 2019 and backed by billions of euros in public and private funding, EuroQCI mandates that all member states integrate quantum key distribution into their governmental and critical infrastructure networks by 2027. As per the Italian Ministry of Technological Innovation, operational terrestrial QKD segments are already in place across multiple countries, with the Italian segment securing transmissions between Rome, Milan, and Turin government nodes. The initiative explicitly excludes non European vendors from core infrastructure components, compelling domestic firms like ID Quantique and Toshiba Europe to localize R&D and manufacturing. As per the European Defence Fund, significant funding has been allocated specifically for quantum secure military communications, accelerating dual use technology development. This policy driven ecosystem ensures sustained demand for quantum communication hardware, software, and integration services while reinforcing Europe’s strategic autonomy in an era of digital fragmentation and geopolitical tech rivalry.

MARKET RESTRAINTS

Immature Quantum Repeater Technology Limiting Network Scalability

The absence of functional quantum repeaters severely constrains the geographic reach and practical deployment of quantum communication networks across Europe, which is significantly hampering the European quantum communication market. As per the Fraunhofer Institute for Telecommunications, current QKD systems suffer from exponential photon loss in optical fiber, limiting point to point transmission under real world conditions. This necessitates trusted node architectures where intermediate stations decrypt and re encrypt keys, a vulnerability that contradicts end to end quantum security principles. The European Quantum Internet Alliance acknowledges that quantum repeaters based on quantum memory and entanglement swapping remain confined to laboratory demonstrations, with no commercially viable solution expected before 2030. Consequently, transcontinental links like the planned connection between Stockholm and Lisbon require numerous trusted nodes, each representing a potential attack surface. The European Commission’s EuroQCI roadmap admits this limitation, noting that satellite based QKD will serve as a temporary bridge until ground-based repeater technology matures.

Prohibitive Deployment Costs and Lack of Standardized Interoperability

Quantum communication infrastructure demands extraordinary capital investment with limited near-term return, which is further deterring widespread adoption beyond government mandates and hindering the expansion of the regional market. As per the European Photonics Industry Consortium, QKD transmitter receiver pairs are costly, excluding fiber leasing, co-location fees, and dedicated dark fiber requirements. Deploying a metropolitan QKD network covering government sites typically requires millions of euros, far exceeding the cost of equivalent classical encrypted links. Compounding this, the absence of universal standards fragments the market, with platforms from different vendors preventing interoperability without costly gateway solutions. As per the European Telecommunications Standards Institute, a unified QKD interface standard has yet to be ratified despite years of deliberation, forcing laboratories and agencies to commit to single vendor ecosystems. As per the European Court of Auditors, EuroQCI has been criticized for lacking cost benefit analysis, noting that many national segments operate below capacity due to insufficient use cases. Without dramatic cost reduction and standardized interfaces, quantum communication will remain a niche solution confined to high security enclaves rather than broad commercial deployment.

MARKET OPPORTUNITIES

Integration with 5G and Future 6G Mobile Networks

Europe’s leadership in 5G deployment creates a strategic opening to for the European quantum communication market. As per the European 5G Observatory, multiple EU countries have launched commercial 5G services, with dense small cell networks providing ideal platforms for QKD integration. As per TU Delft, researchers demonstrated quantum secure handover between 5G base stations using chip based QKD transceivers, showing potential for real time encryption of mobile backhaul traffic. As per the European Commission’s Hexa-X project, significant funding has been allocated to develop 6G architecture incorporating quantum safe security layers by design. Telecom operators like Deutsche Telekom and Orange are piloting hybrid networks where QKD secures the fronthaul between central units and distributed units, protecting against SIM swap and IMSI catching attacks. As 5G expands to industrial IoT applications, the demand for quantum authenticated device identity management will surge. This convergence positions quantum communication as an essential enabler of trustworthy autonomous systems in smart factories, connected vehicles, and critical utilities.

Quantum Secure Cloud Services for Financial and Healthcare Sectors

European financial institutions and healthcare providers face mounting regulatory pressure to adopt quantum resistant security for sensitive data, which is creating demand for quantum key distribution as a cloud delivered service and is another major opportunity in the regional market. As per the European Banking Authority, guidelines mandate that all high value transactions implement post quantum cryptography or quantum key distribution by 2027. In response, cloud providers like OVHcloud launched services offering QKD protected storage for customer master keys with guaranteed forward secrecy. Similarly, the European Health Data Space regulation requires end to end encryption for cross border patient records, with quantum communication providing verifiable security against future decryption threats. Swissquote Bank already uses ID Quantique’s QKD link to secure inter data center replication of trading algorithms. As per the European Medicines Agency, clinical trial data must remain confidential for decades, making quantum secure archives a compliance necessity. These sector specific use cases enable quantum communication providers to monetize infrastructure through subscription models, transforming capital intensive hardware into scalable service revenue.

MARKET CHALLENGES

Geopolitical Fragmentation and Export Control Restrictions

Europe’s quantum communication ambitions are undermined by geopolitical tensions that restrict access to critical components and collaborative research, which is one of the leading challenges to the European quantum communication market growth. As per US export controls, restrictions prohibit the sale of high efficiency single photon detectors and cryogenic cooling systems to entities involved in Chinese quantum projects, complicating European supply chains through re export clauses. As per ID Quantique, delays in acquiring superconducting nanowire detectors from US suppliers have occurred due to licensing reviews. As per the European Raw Materials Alliance, Europe imports the majority of rare earth elements essential for quantum light sources from Chinese manufacturers, creating dependency risks. The EU’s own dual use regulation further fragments development by requiring individual member state approvals for quantum component exports, slowing academic collaboration. These restrictions impede the integrated supply chain necessary for cost effective scaling, forcing European firms to invest in redundant domestic alternatives that lack performance parity. Without coordinated international frameworks, Europe’s quantum communication ecosystem will remain vulnerable to external disruptions despite its strategic intentions.

Shortage of Specialized Quantum Engineering Talent

Europe faces a critical deficit in quantum literate engineers capable of designing, deploying, and maintaining quantum communication infrastructure, which is further challenging the expansion of the European quantum communication market. As per the European Quantum Industry Consortium, there is a significant shortfall of quantum specialists, with only a limited number of graduates annually from dedicated quantum engineering programs across EU universities. Traditional telecommunications engineers lack training in quantum optics, cryogenics, and single photon detection, creating a skills gap that delays project implementation. As per Germany’s Quantum Technology Competence Center, many EuroQCI pilot sites experienced deployment delays due to staffing shortages. Vocational training remains underdeveloped, with few technical colleges offering quantum technician certifications recognized across member states. The situation worsens in Southern and Eastern Europe where brain drain to US and Swiss institutions depletes local talent pools. As per the EU’s Quantum Flagship program, only a small portion of its annual budget is allocated to workforce development. Without urgent investment in education and cross border credential recognition, Europe’s quantum communication rollout will stall not from technological limits but from human capital constraints.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

CAGR |

38.58% |

|

Segments Covered |

By, Transmission Medium, Offering, Enterprise Size, Vertical, and By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

AT&T Inc., ID Quantique SA, Thales Group S.A., IDEMIA SAS, QuintessenceLabs Pty Ltd., QuantumCTek Co., Ltd., QNu Labs Pvt. Ltd., Quantum Xchange, Inc., MagiQ Technologies, Inc., Aliro Technologies, Inc. |

SEGMENTAL ANALYSIS

By Transmission Medium Insights

The fiber-based quantum key distribution segment held 85.5% of the regional market share in 2025. The dominance of fiber-based segment in the European market is driven by the continent’s extensive existing fiber optic infrastructure which provides a ready-made backbone for terrestrial QKD deployment. As per the Body of European Regulators for Electronic Communications, large amounts of dark fiber are available across EU member states, which is enabling cost effective integration without new civil engineering works. Government networks lead adoption, with Germany’s QKD backbone connecting Berlin, Bonn, and Munich utilizing dedicated fiber leased from Deutsche Telekom under national security provisions. The technology’s maturity further reinforces its position, with commercial systems from ID Quantique and Toshiba achieving secure key rates sufficient for encrypting high value administrative communications. As per the European Telecommunications Standards Institute, interoperability requirements defined under ETSI GR QKD 014 ensure seamless cross border connectivity. These infrastructural, regulatory, and operational advantages make fiber based QKD the default choice for near term quantum secure communications across Europe.

The free space and satellite-based quantum key distribution segment is expected to expand at a CAGR of 33.5% over the forecast period owing to the urgent need to overcome distance limitations inherent in fiber-based systems. As per the European Space Agency’s SAGA mission, scheduled for launch in 2026, quantum communication payloads will enable intercontinental secure links. National initiatives complement this effort, with France’s Commissariat à l’Énergie Atomique demonstrating satellite QKD using adaptive optics to compensate for atmospheric turbulence. As per the European Defence Fund, significant funding has been allocated for space-based quantum secure communications to protect military assets deployed globally. Additionally, island nations like Malta and Cyprus require satellite links due to lack of submarine fiber connectivity, creating niche demand. As quantum repeater technology remains years from commercialization, satellite QKD emerges as the only viable solution for pan European and global quantum secure networking.

By Offering Insights

The solutions segment led the market by capturing 71.6% of the European market share in 2025. The growth of the solutions segment in the European market is attributed to the capital-intensive nature of quantum infrastructure deployment where hardware and software platforms represent the primary investment. Government agencies procuring QKD systems typically acquire integrated solutions including photon sources, single photon detectors, control electronics, and key management software as turnkey packages. ID Quantique’s Clavis platform and Toshiba’s QKD systems command significant traction due to compliance with ETSI standards and pre certification by national cybersecurity agencies. The EuroQCI initiative mandates standardized solution architectures across member states to ensure interoperability. Furthermore, solution vendors embed unique device identification and audit logging features required under the EU Cyber Resilience Act. The high entry barrier limits competition to a handful of specialized firms that bundle hardware and software into comprehensive offerings. These structural and regulatory factors ensure solutions remain the dominant revenue stream in Europe’s quantum communication ecosystem.

The services segment is anticipated to record a CAGR of 29.1% over the forecast period owing to the increasing complexity of maintaining and operating quantum communication infrastructure. Managed QKD services now offer continuous monitoring of network parameters to ensure cryptographic integrity. As per ENISA, many EuroQCI pilot sites outsource network operations to specialized service providers due to shortages of quantum literate engineers. Consulting services also expand rapidly, with firms like Atos and Thales providing quantum risk assessments aligned with NIS2 Directive requirements. Training services address the talent gap, with the European Quantum Flagship program certifying technicians to operate and troubleshoot QKD networks. Additionally, cloud-based quantum key delivery services enable financial institutions to access quantum secured keys without owning physical infrastructure. As quantum networks scale beyond metropolitan corridors, the demand for specialized operational support will continue accelerating.

By Vertical Insights

The government and defense entities segment held the major share of 60.3% of the European market share in 2025. The growth of the government and defense segment in the European market can be credited to the national security imperatives driving early adoption of quantum secure communications to protect classified information and critical infrastructure. All EU member states participate in the EuroQCI initiative which mandates quantum protected links between ministries, defense headquarters, and intelligence agencies by 2027. Germany’s Federal Office for Information Security already operates a QKD network securing parliamentary communications, while France’s ANSSI protects nuclear command and control signals across EDF facilities. As per the European Defence Fund, significant funding has been allocated specifically for quantum secure military communications including battlefield key distribution and satellite based secure links for deployed forces. Classified projects like the UK’s Quantum Metrology Institute develop tamper proof QKD systems for diplomatic communications. These strategic investments create sustained demand insulated from commercial budget cycles, establishing government and defense as the foundational vertical for Europe’s quantum communication ecosystem.

The banking, financial services, and insurance segment is estimated to register a CAGR of 23.9% over the forecast period. The stringent regulatory mandates requiring quantum resistant security for high value financial transactions is primarily driving the expansion of BFSI segment in the European market. As per the EBA’s guidelines, systemically important institutions must implement post quantum cryptography or quantum key distribution for interbank settlements by 2027. Swissquote Bank already uses ID Quantique’s QKD link to secure algorithmic trading replication between data centers. Cross border payment systems face particular pressure, with platforms requiring forward secrecy against future decryption threats. Cloud providers respond with quantum safe vault services enabling mid-sized banks to access QKD protected key storage without capital expenditure. Additionally, insurance firms handling sensitive actuarial data for long term policies require confidentiality guarantees that only quantum communication can provide. As financial digitization intensifies and cyber threats evolve, BFSI transitions from experimental pilots to operational quantum secure infrastructure.

COUNTRY ANALYSIS

Germany Quantum Communication Market Analysis

Germany held the dominating position in the Europe quantum communication market in 2025 with 25.5% of the regional market share. The dominance of Germany in the European market can be credited to its leadership in the EuroQCI initiative and robust national quantum strategy backed by billions of euros in public funding. The Federal Office for Information Security operates a QKD backbone connecting Berlin, Bonn, and Munich that secures parliamentary communications and critical infrastructure control signals. Germany’s industrial base amplifies demand, with Siemens and Bosch integrating QKD into smart factory networks. The Fraunhofer Society maintains multiple quantum communication testbeds that accelerate technology transfer from academia to industry. Educational institutions like TU Munich graduate the highest number of quantum engineers annually in Europe, addressing workforce constraints. Strict enforcement of the Cyber Resilience Act mandates quantum secure solutions for critical operators, creating predictable demand. These structural advantages position Germany as the undisputed hub for quantum communication research, deployment, and standardization in Europe.

France Quantum Communication Market Analysis

France held 18.3% of the Europe quantum communication market share in 2025. The nation’s strength lies in its integrated national quantum plan allocating significant funding with strong emphasis on sovereign secure communications. The National Cybersecurity Agency ANSSI deploys QKD to protect electricity grid control signals across EDF’s nuclear reactors, securing critical energy infrastructure. France leads in space-based quantum communication, with the Commissariat à l’Énergie Atomique demonstrating satellite QKD using adaptive optics to compensate for atmospheric turbulence. Defense applications drive innovation, with the Direction Générale de l’Armement funding battlefield communication systems under the Scorpion modernization program. Academic excellence at institutions like Sorbonne University produces large numbers of quantum specialists annually who feed into national laboratories and startups. The ANSSI certification process for QKD systems creates a quality benchmark adopted across EU member states, reinforcing France’s regulatory influence. These factors combine to make France a leader in both terrestrial and space-based quantum secure communications.

United Kingdom Quantum Communication Market Analysis

The United Kingdom is predicted to showcase a promising CAGR in the Europe quantum communication market over the forecast period. Despite Brexit related uncertainties, the UK maintains strong quantum leadership through its National Quantum Strategy focused on secure communications. The Quantum Metrology Institute at NPL developed tamper proof QKD systems for diplomatic communications deployed across Foreign Commonwealth and Development Office missions globally. Financial services drive commercial adoption, with London hosting quantum secure data centers serving banks that comply with Bank of England’s quantum risk management guidelines. The UK’s regulatory environment supports innovation, with the National Cyber Security Centre pioneering certification protocols for QKD systems. Academic excellence at Oxford and Cambridge produces hundreds of quantum engineers annually who feed into startups like Arqit specializing in satellite based QKD. English language dominance facilitates global standardization influence while maintaining sovereign capabilities through partnerships with Five Eyes allies. These dynamics position the UK as a bridge between European and transatlantic quantum secure communication ecosystems.

Switzerland Quantum Communication Market Analysis

Switzerland is estimated to account for a notable share of the Europe quantum communication market over the forecast period. The country’s strategic advantage lies in its neutrality, scientific excellence, and homegrown quantum champions like ID Quantique. Swiss banks leverage QKD to secure inter data center replication of trading algorithms with real time key rotation, meeting stringent cybersecurity requirements. The SwissQuantum network connecting Geneva, Lausanne, and Zurich has operated continuously for over a decade, providing unmatched reliability data. Neutrality enables Switzerland to serve as a trusted node for international organizations, with CERN and the World Health Organization using Swiss QKD infrastructure for confidential communications. ETH Zurich and EPFL produce large numbers of quantum specialists annually who maintain the country’s technological edge. Although not an EU member, Switzerland participates in EuroQCI through bilateral agreements ensuring interoperability with European networks. These attributes position Switzerland as a premium provider of quantum secure communications for finance, diplomacy, and science.

Netherlands Quantum Communication Market Analysis

The Netherlands is projected to witness a healthy CAGR in the Europe quantum communication market during the forecast period owing to its advanced digital infrastructure and central role in European quantum research through QuTech, the Delft based collaboration between TU Delft and TNO. The Dutch government operates a QKD network connecting The Hague, Amsterdam, and Rotterdam that secures communications between ministries and the Royal Netherlands Navy. The Port of Rotterdam deploys quantum secure communications to protect automated cargo handling systems from cyber sabotage. Academic excellence drives innovation, with QuTech demonstrating the first multi node quantum network connecting processors via entanglement swapping. The Netherlands hosts major quantum component manufacturers like PhotonFirst that supply single photon detectors to European QKD systems. Participation in the EuroQCI initiative ensures alignment with continental standards while Dutch cybersecurity agency DGCYBER provides certification frameworks adopted across Benelux. These factors position the Netherlands as a nexus for quantum communication research, industrial application, and component manufacturing in Northwest Europe.

COMPETITIVE LANDSCAPE

The Europe quantum communication market features intense competition among specialized quantum startups established defense contractors and global technology firms vying for dominance in a strategically vital and highly regulated domain. Differentiation arises through national security certifications from agencies like ANSSI BSI and NCSC which act as significant entry barriers for non-European vendors. Competition centers on interoperability within the EuroQCI framework where adherence to ETSI standards determines eligibility for public procurement. While ID Quantique and Toshiba lead in commercial QKD hardware Thales Airbus and Atos leverage defense contracts to develop sovereign solutions insulated from geopolitical supply chain risks. The absence of mature quantum repeater technology limits network scalability favoring companies with strong terrestrial fiber integration capabilities. Academic spin offs from institutions like TU Delft and University of Geneva introduce disruptive innovations but struggle with commercial scaling against well-funded incumbents. Continuous advancement in photon detection efficiency key generation rates and system ruggedness remains critical to maintaining competitive advantage in this capital intensive and policy driven market.

KEY MARKET PLAYERS

A few of the dominating players that are in the Europe quantum communication market are

- AT&T Inc.

- ID Quantique SA

- Toshiba Europe Ltd

- Thales Group S.A.

- IDEMIA SAS

- QuintessenceLabs Pty Ltd.

- QuantumCTek Co., Ltd.

- QNu Labs Pvt. Ltd.

- Quantum Xchange, Inc.

- MagiQ Technologies, Inc.

- Aliro Technologies, Inc.

Top Players in the Market

- ID Quantique SA is a pioneering force in the Europe quantum communication market as the world’s first company to commercialize quantum key distribution technology. Founded by researchers from the University of Geneva, the company supplies QKD systems, quantum random number generators, and quantum safe network encryption solutions to governments financial institutions and critical infrastructure operators across Europe. In recent developments, ID Quantique enhanced its Clavis platform with ETSI compliant interfaces and real time monitoring of quantum bit error rates to meet EuroQCI interoperability requirements. It also partnered with Swiss banks to deploy quantum secure data replication between Zurich and Luxembourg, demonstrating compliance with FINMA cybersecurity mandates. The company actively contributes to global standardization through the International Telecommunication Union, reinforcing Europe’s leadership in quantum security protocols.

- Toshiba Europe Ltd plays a critical role in advancing fiber-based quantum communication through its Cambridge Research Laboratory which developed high speed twin field QKD capable of 600 kilobits per second over 100 kilometers. The company supplies integrated QKD systems to European government networks including the UK’s Quantum Network and Germany’s QKD backbone, emphasizing compatibility with existing telecom infrastructure. Recently, Toshiba Europe launched a managed QKD service for financial institutions that includes continuous performance monitoring and cyber resilience certification by TÜV Rheinland. It also collaborated with Deutsche Telekom to integrate QKD into 5G mobile backhaul networks, enabling quantum secure fronthaul protection for industrial IoT applications. These initiatives position Toshiba as a key enabler of scalable quantum secure communications across regulated European sectors.

- Thales Group significantly contributes to the Europe quantum communication market through its sovereign cybersecurity solutions for defense government and aerospace applications. The company develops tamper resistant QKD terminals certified by ANSSI and BSI for classified communications, with deployments across French and German military networks. In recent actions, Thales integrated quantum key management into its CyberShield platform to provide hybrid classical quantum encryption for critical national infrastructure. It also partnered with the European Space Agency on the SAGA satellite mission to develop space qualified quantum light sources for intercontinental secure links. Thales leads the European Quantum Communication Infrastructure consortium’s work package on trusted node security, ensuring end to end protection for EuroQCI’s pan European network. These efforts reinforce Europe’s strategic autonomy in high assurance quantum communications.

Top Strategies Used By The Key Market Participants

Key players in the Europe quantum communication market prioritize regulatory compliance by aligning their quantum key distribution systems with EuroQCI technical specifications and national cybersecurity agency certifications. They invest heavily in interoperability development to ensure seamless integration across heterogeneous fiber networks and cross border connectivity within the EU framework. Companies offer managed security services including continuous quantum channel monitoring and threat detection to address the shortage of specialized quantum engineering talent. Strategic partnerships with telecom operators enable co location of QKD systems within existing infrastructure reducing deployment costs and accelerating adoption. Additionally, firms actively participate in European standardization bodies like ETSI and contribute to global forums to shape quantum communication protocols and maintain technological leadership.

MARKET SEGMENTATION

This research report on the Europe quantum communication market is segmented and sub-segmented into the following categories.

By Transmission Medium

- Fiber-Based QKD

- Free-Space/Satellite-Based QKD

By Offering

- Solution

- Quantum Communication Components

- Photon Sources

- Quantum Detectors

- Quantum Memory

- Quantum Repeaters & Others

- Quantum Key Distribution (QKD) Solutions

- Quantum Random Number Generator (QRNG)

- Quantum-Safe Cryptographic Solutions

- Quantum Communication Components

- Services

By Enterprise Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By Vertical

- BFSI

- Government & Defense

- Healthcare

- Energy & Utilities

- IT & Telecom

- Aerospace

- Other Vertical

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe