Latin America E-learning Market Size, Share & Growth, 2033

Latin America E-learning Market Size

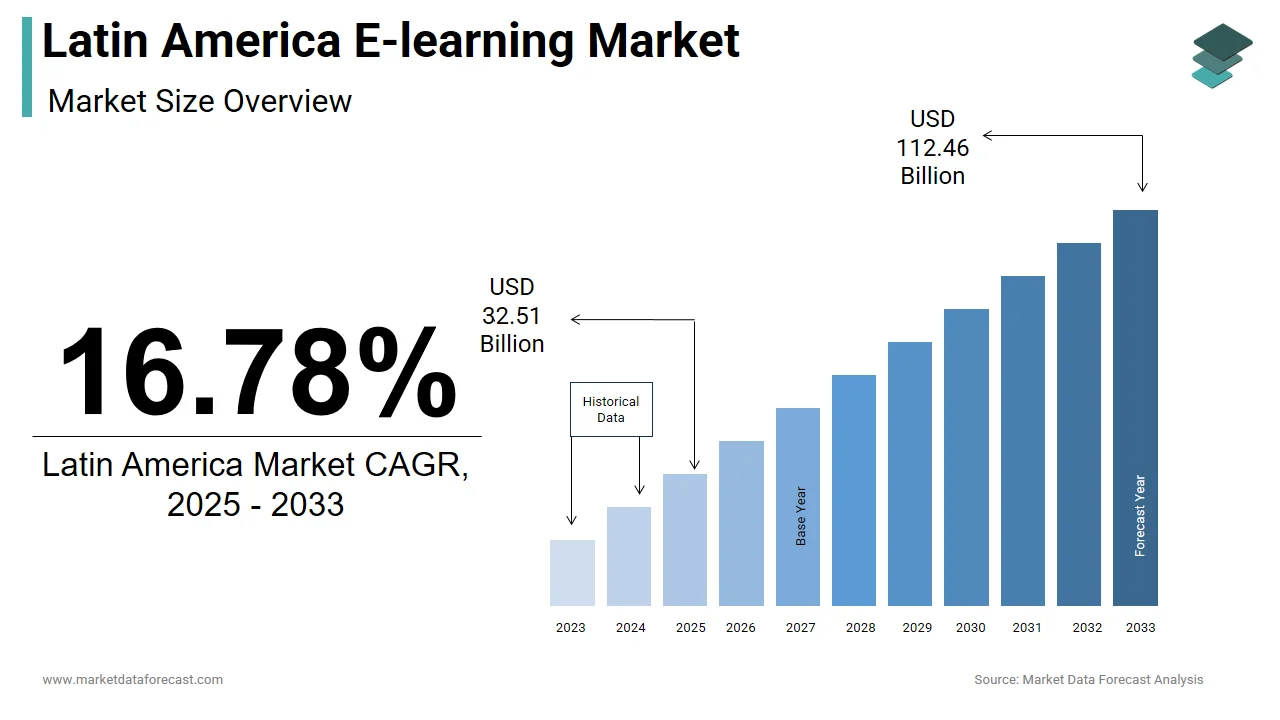

The size of the Latin America e-learning market was valued at USD 27.84 billion in 2024. This market is expected to grow at a CAGR of 16.78% from 2025 to 2033 and be worth USD 112.46 billion by 2033 from USD 32.51 billion in 2025.

The Latin America e-learning market incorporates digital platforms, software, and services that facilitate remote and technology-driven education across academic institutions, corporate training centers, and government initiatives. This market includes online learning management systems (LMS), virtual classrooms, mobile learning applications, and cloud-based educational content tailored for students, professionals, and lifelong learners. The adoption of e-learning has accelerated in recent years due to evolving educational models, increasing internet penetration, and a growing emphasis on skill development in a rapidly changing job landscape.

MARKET DRIVERS

Increasing Adoption of Digital Learning in Educational Institutions

One of the primary drivers fueling the growth of the Latin America e-learning market is the widespread adoption of digital learning platforms by educational institutions at all levels. Universities, technical colleges, and K-12 schools are increasingly integrating Learning Management Systems (LMS) and virtual classrooms to enhance teaching methodologies and improve student engagement. In Brazil, where higher education enrollment exceeds 9 million students, a notable share of universities now offer blended or fully online programs. As institutions continue to modernize pedagogical approaches, the demand for scalable and interactive e-learning solutions continues to rise across Latin America.

Growth of Remote Work and Corporate Upskilling Programs

The shift toward remote work and the increasing need for continuous professional development have significantly boosted the demand for e-learning platforms in the corporate sector across Latin America. Companies are investing in digital training programs to upskill employees, ensure compliance with industry standards, and maintain competitiveness in a rapidly evolving economy. According to the International Labour Organization, approximately 27% of professionals in urban areas across Brazil, Mexico, and Chile worked remotely at least three days a week in 2023. This trend has prompted organizations to adopt e-learning platforms for onboarding, leadership training, and technical skill development. In Brazil alone, major corporations such as Petrobras and Natura have expanded their use of online training modules to reach geographically dispersed teams efficiently.

MARKET RESTRAINTS

Limited Internet Access and Digital Infrastructure Gaps

A significant restraint affecting the Latin America e-learning market is the uneven availability of high-speed internet and inadequate digital infrastructure, particularly in rural and underdeveloped regions. While major metropolitan areas in Brazil, Mexico, and Chile enjoy stable connectivity, many smaller cities and towns still face challenges related to latency, bandwidth limitations, and intermittent service disruptions. In countries like Bolivia, Honduras, and Paraguay, internet speeds often fall below the threshold required for seamless participation in online courses. The Inter-American Development Bank reports that in parts of Central America, average broadband speeds remain below 10 Mbps, making it difficult for students and professionals to engage with video-based learning and interactive training modules.

Resistance to Digital Transformation in Traditional Educational Institutions

Despite growing technological advancements, resistance to digital transformation remains a key challenge for the Latin America e-learning market, particularly within traditional educational institutions. Many public schools and universities continue to rely on conventional classroom instruction, lacking both the resources and institutional will to integrate e-learning tools effectively. In several countries, teacher training programs do not include digital pedagogy, resulting in limited proficiency in using online learning platforms. According to UNESCO’s 2023 report on education reform in Latin America, only 35% of educators in public schools across the region felt adequately prepared to implement digital teaching methods. Apart from these, bureaucratic hurdles and budget constraints often delay the procurement of necessary digital infrastructure.

MARKET OPPORTUNITIES

Expansion of Artificial Intelligence and Adaptive Learning Platforms

The integration of artificial intelligence (AI) and adaptive learning technologies presents a significant opportunity for the Latin America e-learning market by enabling personalized, data-driven education experiences. AI-powered platforms can analyze learner behavior, track progress, and deliver customized content, enhancing engagement and knowledge retention across academic and professional settings. In Brazil, the Ministry of Education launched an initiative in 2023 to pilot AI-based learning assistants in select public universities, aiming to reduce dropout rates and improve academic performance.

Rise of Mobile-Based Learning and Microlearning Platforms

The proliferation of smartphones and mobile internet access has created new opportunities for mobile-based learning and microlearning platforms in Latin America. These platforms deliver bite-sized, on-demand educational content that aligns with users’ schedules and learning preferences, making them especially effective for working professionals and informal learners. According to the study, mobile internet penetration in Latin America reached 65% in 2023, providing a strong foundation for mobile-first e-learning solutions. In Mexico, major edtech companies have launched gamified mobile apps offering short-duration courses in business, programming, and personal finance, attracting millions of users. In Brazil, where smartphone ownership exceeds 80%, universities and vocational institutes are increasingly adopting mobile-friendly LMS platforms to supplement traditional instruction.

MARKET CHALLENGES

Cybersecurity Threats and Data Privacy Concerns

Cybersecurity threats pose a major challenge to the Latin America e-learning market, as educational institutions and corporate training providers increasingly store sensitive student and employee data in digital environments. The rise in ransomware attacks, phishing scams, and unauthorized access incidents has raised concerns about the security of online learning platforms and the protection of personal information. According to INTERPOL’s 2023 Cybercrime Report, Latin America experienced a 21% increase in cyberattacks targeting educational institutions, including e-learning platforms and university databases. Additionally, regulatory frameworks such as Brazil’s General Data Protection Law (LGPD) and Mexico’s Federal Law on Protection of Personal Data Held by Private Parties impose strict requirements on data handling and storage. However, inconsistent enforcement and a lack of standardized security protocols across institutions create gaps in compliance.

High Initial Investment Costs and Return-on-Investment Uncertainty

Despite the long-term benefits of e-learning, many Latin American institutions—especially small and medium-sized educational providers—face financial barriers due to high initial implementation costs and uncertainty regarding return on investment (ROI). Transitioning from traditional teaching methods to digital platforms involves not only purchasing licenses but also expenses related to infrastructure upgrades, staff training, and content development. According to the International Trade Centre, over 60% of private schools and vocational training centers in Peru and Ecuador cited budget constraints as the primary reason for delayed e-learning adoption in 2023. Moreover, inconsistent pricing models among e-learning platform providers create confusion and hesitation among potential buyers. Some institutions find it challenging to forecast long-term expenditures due to variable subscription fees and integration costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Delivery Mode, Learning Type, Technology, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Adobe, Inc., Apollo Education Group, Inc., Aptara, Inc., Articulate Global, LLC, Baidu, Inc., Blackboard, Inc., CERTPOINT, Cisco Systems, Inc., Citrix Systems, Inc., D2L Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, SAP SE, and others. |

SEGMENTAL ANALYSIS

By Delivery Mode Insights

The Self-paced e-learning segment had the maximum portion of the Latin America e-learning market, i.e., 48.1% of total revenue in 2024. This segment’s dominance is primarily driven by its flexibility and accessibility, allowing learners to engage with content at their convenience without being bound to fixed schedules. Similarly, in Mexico, edtech platforms such as Kueski and Laboratoria have gained traction by offering modular, mobile-friendly courses that cater to working adults seeking career advancement. The scalability and cost-effectiveness of this delivery mode make it particularly appealing to corporate training programs as well.

Blended or hybrid e-learning is emerging as the fastest-growing delivery mode within the Latin American e-learning market, projected to expand at a CAGR of 14.9%. This growth is fueled by increasing recognition of the benefits of combining digital instruction with in-person engagement to enhance learning outcomes. A key driver is the shift in educational policy toward hybrid learning models, especially in higher education. Corporate training departments are also leveraging blended approaches to provide immersive yet flexible professional development experiences. With growing support from policymakers and institutions, blended/hybrid e-learning is rapidly transforming the Latin American education landscape.

By Learning Type Insights

Academic e-learning represented the largest segment in the Latin America e-learning market by capturing an estimated market share of 55% in 2024. This is because of the widespread integration of digital learning tools in schools, colleges, and universities across the region. Similarly, in Mexico, the Ministry of Public Education has mandated the inclusion of digital resources in national curricula, prompting widespread implementation of e-learning tools across public and private schools. As institutions continue to modernize pedagogical approaches, the demand for scalable and interactive academic e-learning solutions continues to rise across Latin America.

Corporate e-learning is the fastest-growing segment in the Latin America e-learning market, projected to expand at a CAGR of 15.4. This quick rise is driven by increasing investment in employee upskilling, digital transformation in business operations, and the need for compliance training. A major contributing factor is the growing emphasis on continuous professional development in response to technological advancements and shifting labor market demands. With businesses recognizing the cost-effectiveness and scalability of digital training, the corporate e-learning sector is poised for sustained growth in Latin America.

By Technology Insights

Learning Management Systems (LMS) dominated the Latin America e-learning market by holding a 51.9% of the total market share in 2024. This leading position is attributed to the widespread adoption of LMS platforms by educational institutions, government agencies, and corporate organizations seeking centralized control over course delivery, progress tracking, and learner engagement. Corporate training departments in Chile and Colombia are also leveraging LMS platforms to streamline employee onboarding, compliance training, and performance evaluations. With continued institutional backing and technological advancements, LMS remains the foundational technology driving e-learning adoption across Latin America.

Mobile e-learning is the fastest expanding technology segment in the Latin America e-learning market, projected to expand at a CAGR of 16.2%. This growth is driven by rising smartphone penetration, increasing mobile internet usage, and the demand for on-the-go learning experiences tailored to modern lifestyles. In Mexico, major edtech companies have launched gamified mobile apps offering short-duration courses in business, programming, and personal finance, attracting millions of users. In Brazil, universities and vocational institutes are increasingly adopting mobile-friendly LMS platforms to supplement traditional instruction. As mobile learning continues to evolve, the Latin America e-learning market is well-positioned to capitalize on this shift, offering flexible and accessible learning solutions tailored to diverse user needs.

COUNTRY LEVEL ANALYSIS

Brazil was the leading market contributor with strong institutional support. As the region’s largest economy and a hub for technological innovation, Brazil benefits from strong institutional backing and a mature digital ecosystem that supports e-learning adoption across both public and private sectors. The country’s digital transformation agenda has prioritized e-learning as a core component of modern education reform. Corporate investment in digital training has also surged, with major firms such as Petrobras and Itaú Unibanco expanding their use of e-learning platforms for employee upskilling.

Mexico’s strategic location, deep integration with North American supply chains, and strong presence of multinational corporations make it a key player in e-learning adoption. A major growth driver is the rapid digitalization of education and workforce training. Government initiatives also play a crucial role. Furthermore, cross-border collaboration with U.S.-based edtech firms enhances access to global best practices and advanced learning technologies.

Argentina has been actively promoting e-learning through updated education policies and investments in digital infrastructure aimed at improving access and quality. This effort includes equipping public schools with interactive learning tools and expanding access to online courses for students and educators. Additionally, the National Ministry of Education partnered with local tech firms to develop bilingual e-learning content for Spanish and Portuguese speakers

Chile consistently ranks among the most digitally advanced nations in Latin America, fostering strong adoption of e-learning across both public and private sectors. The Chilean government has been proactive in promoting digital education through initiatives such as the National Digital Transformation Strategy, which encourages schools and universities to adopt e-learning platforms. In higher education, leading universities like Universidad de Chile and Pontificia Universidad Católica de Chile have integrated AI-driven tutoring systems into their curricula to enhance personalized learning experiences. Additionally, the country’s mining industry, a key economic pillar, utilizes e-learning for workforce training in safety protocols and equipment operation.

The Rest of Latin America has diversified growth across emerging markets. This segment exhibits diversified growth driven by expanding digital economies, increasing internet penetration, and rising investments in e-learning infrastructure. Colombia’s e-learning market is being propelled by the government’s “Digital Transformation Plan” which seeks to integrate e-learning tools into public education and vocational training. Meanwhile, Peru’s Ministry of Education reports that mobile-based learning applications are gaining popularity among students in rural areas with limited access to traditional schooling. In Central America, countries like Costa Rica and Panama are attracting foreign investment due to their stable business environments and growing edtech ecosystems.

KEY MARKET PLAYERS

Noteworthy Companies dominating the Latin America E-learning market profiled in the report are Adobe, Inc., Apollo Education Group, Inc., Aptara, Inc., Articulate Global, LLC, Baidu, Inc., Blackboard, Inc., CERTPOINT, Cisco Systems, Inc., Citrix Systems, Inc., D2L Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, SAP SE., and others.

TOP LEADING PLAYERS IN THE MARKET

Coursera

Coursera is a leading global provider of online learning, offering a vast catalog of courses, certifications, and degree programs from top universities and institutions. In Latin America, Coursera plays a critical role in bridging skill gaps by delivering accessible, high-quality education to students and professionals. The company collaborates with local governments and academic institutions to tailor content that aligns with regional labor market demands. Coursera’s flexible platform supports both self-paced and instructor-led learning, making it a preferred choice for corporate training and personal development across the region.

Blackboard Inc.

Blackboard Inc. is a key player in the Latin America e-learning market, specializing in digital learning platforms and educational technology solutions for higher education and K-12 institutions. The company provides comprehensive Learning Management Systems (LMS) that support virtual classrooms, assessment tools, and collaborative learning environments. Blackboard’s presence in Latin America has grown through strategic partnerships with universities and government-backed digital education initiatives. Its focus on user engagement, accessibility, and integration with emerging technologies positions it as a trusted partner for institutions transitioning to digital-first learning models.

Google for Education

Google for Education is a major force in the Latin America e-learning ecosystem, offering cloud-based tools such as Google Classroom, G Suite for Education, and Chromebooks tailored for schools and universities. The platform enables seamless collaboration, real-time feedback, and scalable deployment of digital learning resources. In Latin America, Google actively partners with public education systems to equip teachers and students with affordable, easy-to-use digital tools. Through training programs, policy advocacy, and localized language support, Google continues to strengthen its influence in the region’s evolving e-learning landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Latin America e-learning market are employing several strategic initiatives to consolidate their market position and expand their reach. One major approach is localized content development, where companies tailor course offerings and instructional materials to match regional languages, cultural contexts, and workforce requirements. This enhances relevance and adoption among learners and institutions.

Another widely adopted strategy is strategic partnerships with government and academic institutions. By collaborating with ministries of education and universities, e-learning providers can integrate their platforms into national education frameworks, ensuring long-term sustainability and scalability.

Lastly, investment in mobile-first and offline-compatible learning solutions allows companies to overcome infrastructure limitations and reach underserved populations. These approaches collectively enable market leaders to build trust, improve accessibility, and drive deeper engagement across diverse learner segments in Latin America.

COMPETITION OVERVIEW

The Latin America e-learning market is highly competitive, with a mix of global tech giants, specialized edtech firms, and local startups vying for market share. International players such as Coursera, Blackboard, and Google for Education dominate due to their extensive course catalogs, established brand recognition, and advanced digital infrastructure. However, regional players are gaining traction by offering cost-effective, culturally relevant, and locally supported solutions tailored to specific country needs. The competition extends beyond product features, encompassing pricing models, ease of integration, customer support, and adaptability to hybrid and remote learning environments. As demand for digital education grows across academic, corporate, and government sectors, market participants are continuously innovating to differentiate themselves through personalized learning experiences, AI-driven analytics, and improved accessibility. Additionally, strategic collaborations, localized content development, and mobile-first approaches are shaping the competitive dynamics, fostering an environment where both global and regional firms can thrive.

RECENT MARKET DEVELOPMENTS

- In January 2024, Coursera expanded its partnership network in Brazil by collaborating with 15 new local universities to offer region-specific online degree programs, aiming to enhance accessibility and relevance for Brazilian learners.

- In March 2024, Google for Education announced the launch of a new digital skills training program in Mexico, targeting 500,000 students and educators with free access to certified online courses in coding, data analytics, and artificial intelligence.

- In May 2024, Blackboard acquired a leading edtech firm based in Argentina to enhance its virtual classroom capabilities and better serve the Latin American education sector with localized features and language support.

- In July 2024, Microsoft launched a new initiative in Chile called “Future Ready,” which provides AI-powered learning modules and digital certification programs for high school students and job seekers across multiple industries.

- In September 2024, a prominent Brazilian e-learning platform partnered with a global cybersecurity company to introduce an integrated suite of secure, enterprise-grade LMS solutions designed specifically for financial institutions and government agencies.

MARKET SEGMENTATION

This Latin America E-learning market research report is segmented and sub-segmented into the following categories.

By Delivery Mode

- Self-Paced E-Learning

- Live Online E-Learning

- Blended/Hybrid E-Learning

By Learning Type

- Academic E-Learning

- Corporate E-Learning

- Government E-Learning

By Technology

- Learning Management System (LMS)

- Mobile E-learning

- Virtual Classroom

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America