Navigating ethical decision-making in digital transformation: ethical climate, digital competence, and person-organization fit in China’s banking sector

Theory

Person-Environment (P-E) fit theory

Person-Environment (P-E) fit theory provides important theoretical insights into how individual characteristics interact with organizational contexts to influence workplace behavior (Armitage & Amar, 2021). Central to this theory is the proposition that the congruence between individual attributes and environmental characteristics leads to positive behavioral outcomes (Ahmad et al. 2024; George, 2022; Treviño et al. 2020). Recent research applying P-E fit theory in organizational ethics has demonstrated that value congruence between employees and their organizations significantly influences ethical behavior and decision-making (George, 2022).

First, P-E fit theory elucidates the mechanism through which ethical climate affects ethical decision-making, with organizational ethical climate serving as a key environmental characteristic that employees evaluate for compatibility with their personal values (Al Halbusi et al. 2021). This theoretical lens helps explain why the same ethical climate may lead to different behavioral outcomes depending on the degree of perceived fit between individual values and organizational ethical standards (Zhao et al. 2021). This study extends this theory by examining how ethical climate influences fit perceptions within digitally transforming Chinese banks—a context where rapidly evolving technologies create unique ethical challenges not addressed in conventional P-E fit applications.

Second, the theory helps understand how digital competence contributes to person-organization fit in contemporary banking environments. As organizations increasingly integrate digital technologies, P-E fit theory suggests that the alignment between employees’ digital capabilities and organizational technological requirements becomes crucial for effective functioning (Cetindamar Kozanoglu & Abedin, 2021). This study advances P-E fit theory by reconceptualizing digital competence as not just a technical attribute but an ethically relevant competence that determines how employees align with organizational values and navigate ethical dilemmas in technology-mediated environments—a previously unexplored theoretical extension.

Third, P-E fit theory supports examining boundary conditions in the relationship between person-organization fit and ethical decision-making (Vleugels et al. 2023). This study contributes new insights by identifying organizational digital ethical culture as a previously unexamined boundary condition that reconfigures how person-organization fit translates into ethical behavior in digital banking contexts, representing a novel integration of digital ethics with P-E fit theory.

Ethical decision-making theory

Ethical decision-making (EDM) theory provides a framework for understanding how individuals identify and respond to ethical dilemmas in organizations (Jones, 1991). Based on Rest’s four-component model, it outlines four key stages: moral awareness, moral judgment, moral intention, and moral behavior (Reynolds, 2006; Weber, 2019). This framework is particularly relevant in digital banking, where employees face complex ethical challenges due to technological advancements. The theory highlights that ethical decision-making is influenced by individual factors, such as cognitive moral development and personal values, as well as situational factors, including organizational context and ethical infrastructure (Jones, 1991; Weber, 2019). This dual focus aligns with the study’s emphasis on how digital competence and organizational ethical climate interact to shape ethical decision-making intentions.

Ethical decision-making in organizations has also been examined through Institutional Theory and Stakeholder Theory, both of which offer alternative perspectives on corporate ethics. Institutional Theory posits that ethical behavior is shaped by external institutional pressures, such as legal frameworks, industry standards, and societal expectations (Jeong & Kim, 2019). Meanwhile, Stakeholder Theory emphasizes the ethical responsibility of organizations toward various stakeholders, including employees, customers, and society at large (Freeman & McVea, 2001). While both theories offer valuable insights into corporate ethics at a macro level, their focus is primarily on external influences, such as organizational policies and institutional constraints, rather than the internal cognitive processes of individuals. In contrast, EDM Theory provides a more structured framework for understanding how employees personally recognize, evaluate, and act upon ethical dilemmas within their work environments.

Recent developments in the theory have addressed the specific complexities of digital environments (Rodgers et al. 2023). In digital contexts, ethical decision-making is influenced not only by technical skills but also by moral capabilities, particularly in navigating the ethical implications of technology-driven decisions (Poszler & Lange, 2024). The role of organizational ethical climate has become even more critical in guiding ethical behavior in digital settings, as it helps employees align with the organization’s ethical standards while making decisions involving new technologies (Younis & Elsaid, 2019). Moreover, higher education levels have been linked to better cognitive moral development, emphasizing the importance of education as a boundary condition that affects ethical decision-making in the digital era (Nguyen et al. 2023). These advancements underscore the growing need to integrate both technical and ethical competencies when making decisions in increasingly digitalized environments.

Ethical climate

Ethical climate represents the collective perception within an organization regarding appropriate ethical behavior and approaches to addressing ethical issues (Koskenvuori et al. 2019; Wimbush & Shepard, 1994). It establishes organizational ethical standards by shaping employees’ understanding of right and wrong, thereby guiding their behavioral choices (Dey et al. 2022; Kuenzi et al. 2020). A positive ethical climate is characterized by strong commitment to ethical standards, emphasis on fairness, and promotion of integrity, which collectively encourage employees to make decisions aligned with organizational values (Al Halbusi et al. 2021; Ding et al. 2025; Kuenzi et al. 2020).

Drawing on ethical decision-making theory, the relationship between ethical climate and ethical decision-making can be explained through several theoretical mechanisms. The theory suggests that organizational ethical climate serves as a critical environmental factor that shapes both moral awareness and moral judgment components of the decision-making process (Arnaud & Schminke, 2011; Helzer et al. 2023). Specifically, ethical climate enhances moral awareness by helping employees recognize ethical issues in their work environment, and supports moral judgment by providing clear standards for evaluating ethical alternatives. This theoretical perspective explains how ethical climate guides employees in recognizing and evaluating ethical issues, particularly in the technologically complex environment of digital banking where traditional ethical boundaries may be less clear.

In the banking sector, these theoretical mechanisms become particularly salient due to the industry’s fiduciary responsibilities and the need to maintain stakeholder trust (Bugandwa et al. 2021). The digital transformation of banking operations has further heightened the importance of ethical climate, as employees navigate complex ethical challenges in automated decision-making, data privacy, and digital service delivery (Wang et al. 2024). For instance, when evaluating algorithmic lending decisions or handling sensitive customer data, employees rely on the organization’s ethical climate as a crucial reference point for appropriate behavior.

Kuenzi et al. (2020) argued that ethical climate serves as a crucial environmental factor that guides ethical decision-making in organizational contexts. According to Alizadeh et al. (2021), ethical climate influences decision-making by providing both cognitive frameworks for recognizing ethical issues and clear standards for evaluating alternatives. Building on these theoretical foundations in digital banking contexts, Aldboush and Ferdous (2023) demonstrated that ethical climate enhances employees’ capacity to navigate complex ethical challenges in digital operations. Similarly, Dinçer et al. (2021) found that banking professionals who perceive strong ethical climates demonstrate higher ethical decision-making intentions, particularly when facing technological complexity. Based on ethical decision-making theory and the empirical evidence, ethical climate provides both the awareness-enhancing and judgment-supporting mechanisms necessary for ethical decision-making in complex digital environments. Therefore:

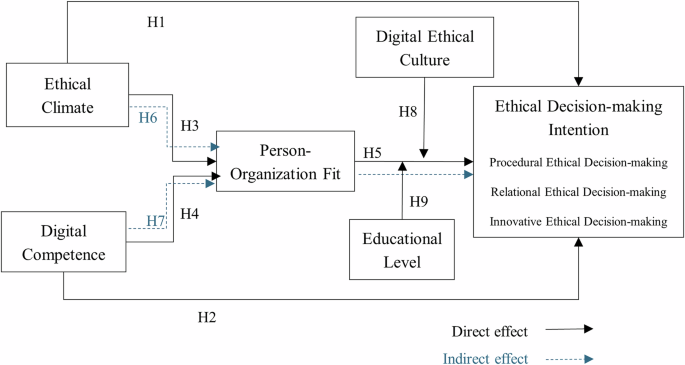

Hypothesis 1: Ethical climate positively influences ethical decision-making intentions among commercial bank employees.

Digital competence

In today’s dynamic digital landscape, digital competence is defined as an individual’s capacity to leverage digital technologies, tools, and resources effectively and confidently for task completion, communication, collaboration, and problem-solving (Antonietti et al. 2022; Falloon, 2020). Recent interpretations of digital competence extend beyond technical skills to include ethical considerations (Ma & Ismail, 2025). As Ochoa Pacheco and Coello-Montecel (2023) explained, digital competence involves not only digital literacy and the ability to navigate digital settings but also the ethical application of digital tools and data. This expanded understanding of digital competence is particularly relevant in banking, where employees interact with complex digital systems, manage sensitive financial information, and make decisions with significant implications (Wang et al. 2024).

Ethical decision-making theory provides a useful lens for exploring how digital competence shapes ethical decision-making intentions. This theory posits that individuals’ ethical decision-making abilities rely on their capacity to identify moral issues and to critically assess alternative actions (DeTienne et al. 2021). In the context of digital technology, digital competence appears to support both elements of ethical decision-making. First, it enhances moral awareness by helping employees recognize ethical risks inherent in digital activities, such as algorithmic bias in lending or data privacy concerns (Kumar et al. 2024). Second, it bolsters moral judgment by providing the technical expertise necessary to evaluate ethical options in digital scenarios (Jedličková, 2024).

This theoretical link is especially pertinent in the banking industry, where digital transformation has redefined operational practices (Kaur et al. 2021). Villar and Khan (2021) suggested that banking employees with advanced digital competence are better equipped to recognize ethical issues within automated systems. Additionally, Aitken et al. (2021) reported that banking professionals with digital expertise make more ethically sound decisions when handling digital financial products and customer data. This connection is particularly crucial in Chinese commercial banks, where rapid technological adoption presents unique ethical challenges in daily operations (X. Chen et al. 2021).

Empirical research consistently validates the association between digital competence and ethical decision-making. Diener and Špaček (2021) found that digitally competent banking professionals exhibit an enhanced awareness of ethical concerns within digital operations. Ashok et al. (2022) further reported that employees with a solid understanding of both the technical and ethical aspects of digital systems are more likely to make carefully considered ethical decisions. Therefore:

Hypothesis 2: Digital competence positively influences ethical decision-making intentions among commercial bank employees.

Person-organization Fit

As a core component of the P-E Fit framework, Person-Organization (P-O) fit provides insights into the alignment between individual attributes and the organizational environment (Chang et al. 2020; Yang & Li, 2021). P-O fit particularly emphasizes how well employees’ values, beliefs, and career aspirations align with the values, beliefs, and long-term goals of the organization (Peng et al. 2024). According to P-E Fit theory, when employees perceive that their personal ethical standards align with the organization’s ethical climate, this alignment fosters greater job satisfaction, organizational commitment, and motivation (Qing et al. 2020). Such alignment not only instills a sense of emotional security and belonging in employees but also strengthens their intrinsic motivation to work toward organizational goals (Wengang et al. 2023). In Chinese commercial banking, where rapid digital transformation brings ethical challenges, a strong fit between employees’ values and the organization’s ethical climate is especially important (Cai et al. 2024). Ethical congruence in this setting helps build a workforce that is not only motivated and committed but also better equipped to handle the ethical complexities of modern banking practices (Wu et al. 2021).

Empirical research supports the role of ethical climate in enhancing P-O fit in Chinese commercial banking. Dey et al. (2022) found that a positive ethical climate encourages employees to align their values with the organization’s mission and goals, strengthening employees’ identification with the organization and fostering a sense of belonging (Wengang et al. 2023). Similarly, Nguyen et al. (2020) noted that investing in ethical practices—such as demonstrating responsibility and transparency—can enhance employees’ organizational identification. When employees witness ethical conduct and accountability within their bank, they are more likely to trust and embrace the organization’s values, which lays a strong foundation for P-O fit (Al Halbusi et al. 2021). Therefore:

Hypothesis 3: Ethical climate positively influences Person-Organization Fit among commercial bank employees.

In the wave of digital transformation in China’s commercial banks, digital competence has become a key element for employees to adapt and drive organizational development (Bikse et al. 2021). Digital competence, defined as the ability of individuals to leverage digital technologies and resources confidently and effectively, extends beyond technical proficiency (Falloon, 2020). It also includes how employees integrate these skills into the organization’s culture, values, and goals, thereby fostering a strong P-O fit (Oberländer et al. 2020).

First, from a skills-matching perspective, Chinese commercial banks are introducing advanced digital systems and innovative financial services, which require employees to have the appropriate digital skills to meet the challenges of their daily work (X. Chen et al. 2021). When employees’ digital competence matches the bank’s technological requirements, they not only complete their tasks efficiently, but also reduce frustration due to technological barriers, thus enhancing job satisfaction and sense of belonging (Selimović et al. 2021). This skill fit is an important component of interpersonal (P-O) fit, which helps employees better integrate into the organization and contribute to the achievement of organizational goals (Villani & Grimaldi, 2024).

Second, digital competence also promotes alignment between employees and the organization in terms of values and goals. In the banking industry, the widespread use of digital technology is often accompanied by concerns about ethical issues such as data privacy and transparency of digital financial products (Varma et al. 2022). Employees with digital competence have not only acquired skills to operate the technology, but also have the sensitivity and ability to deal with these ethical issues (Huu, 2023). This enables them to deal with the ethical implications of technology more effectively while adhering to the organization’s ethical standards. When employees’ digital skills are aligned with the organization’s ethical expectations, they feel more identified with the organization’s mission and values, which enhances loyalty and motivation towards the organization (Cetindamar Kozanoglu & Abedin, 2021).

In addition, Muduli and Choudhury (2024) also pointed out that in a technology-driven banking environment, employees with advanced digital skills show higher levels of organizational identification. They are better able to understand and adapt to technological changes and translate digital skills into tangible contributions to organizational development, which further enhances interpersonal (P-O) fit. This alignment is particularly important for Chinese commercial banks in the midst of digital transformation, helping to build a workforce that is both technically competent and highly loyal and motivated (Zhu et al. 2022). Therefore:

Hypothesis 4: Digital competence positively influences Person-Organization Fit among commercial bank employees.

In the context of strong person-organization fit, employees within Chinese commercial banks are more likely to experience congruence between their personal and organizational values. This alignment fosters not only a cohesive work environment but also supports ethical decision-making by promoting positive ethical performance (Cai et al. 2024). According to P-E Fit theory, when employees experience high congruence with their organization, they are more likely to internalize the organization’s values, norms, and behavioral standards. Specifically, in ethical decision-making contexts, employees whose personal values align closely with those of the organization are more inclined to recognize ethical issues, give due weight to ethical considerations, and thoughtfully assess alternative actions (Shahzad et al. 2024). This alignment elevates their ethical awareness and increases their commitment to adhere to the organization’s ethical expectations.

Furthermore, ethical decision-making theory provides an additional framework to understand this relationship. In Chinese commercial banks where P-O fit is strong, employees are more likely to accept and understand the organization’s ethical standards due to the sense of shared values, which, in turn, strengthens their resolve to make ethical choices when encountering moral dilemmas (Yang & Xu, 2020). The importance of P-O fit is amplified amid the rapid digital transformation occurring in Chinese commercial banks. Ethical challenges, such as safeguarding data privacy, ensuring fairness in lending practices, and maintaining transparency in digital financial services, require employees to factor in ethical responsibilities alongside economic considerations (Huang & Wang, 2023). High P-O fit enables employees to act ethically, fostering behaviors that support the bank’s reputation and long-term sustainability (R. Liu et al. 2023).

Research evidence also highlights the positive impact of P-O fit on ethical decision-making intentions. Helzer et al. (2023) found that employees who felt aligned with the ethical values of their organization showed stronger ethical intentions in their decision-making. Similarly, Ricardo et al. (2024) observed that employees who resonated with the organization’s ethical mission were more likely to prioritize ethical values even under other pressures. Therefore:

Hypothesis 5: Person-Organization Fit positively influences ethical decision-making intentions among commercial bank employees.

Mediating role of person-organization fit

In China, commercial banks are a vital part of the financial system, not only performing core functions such as capital intermediation and credit creation but also playing a critical role in driving economic growth and maintaining financial stability (Yeung, 2021). As the financial market continues to open and competition intensifies, Chinese commercial banks face unprecedented challenges and opportunities. In this context, employees’ ethical decision-making intentions have become crucial factors influencing bank reputation, customer satisfaction, and long-term development (Wu et al. 2021).

Person-Organization Fit (P-O Fit) serves as a critical bridge between employees and the organization, mediating the effects of ethical climate and digital competence on employees’ ethical decision-making intentions. Based on P-E Fit theory, when employees’ values, beliefs, and goals align closely with those of the organization, they are more likely to internalize and follow the organization’s ethical norms, thereby strengthening their ethical decision-making intentions (George, 2022).

First, consider the influence of ethical climate on employees’ ethical decision-making intentions. In Chinese commercial banks, a positive ethical climate can inspire employees’ sense of morality and responsibility, making them more attentive to customer rights and societal benefits (Wu et al. 2021). However, this influence is not direct but is realized through the mediating role of P-O Fit. When employees experience a high level of P-O Fit, they are more likely to recognize and accept the organization’s ethical climate, leading them to make decisions that align with ethical standards in their daily work (Mohan & Chandramohan, 2021).

Similarly, digital competence, as a critical skill for modern commercial bank employees, also indirectly affects their ethical decision-making intentions (Sillat et al. 2021). With the accelerate of digital transformation, digitally skilled employees excel in information processing, communication, collaboration, and problem-solving—all of which are crucial in the ethical decision-making process (Marion & Fixson, 2021). However, the influence of digital competence on ethical decision-making intentions is also mediated by P-O Fit. When employees have a high level of P-O Fit, they are more inclined to use their digital skills to support the organization’s ethical goals and values, such as ensuring transparency, fairness, and legitimacy in decision-making through technological means (Delecraz et al. 2022; Zhu et al. 2022). In contrast, employees with a low level of P-O Fit may misuse their digital skills, potentially engaging in unethical behavior such as data leakage or fraud (Kelebek & Alniacik, 2022). Therefore:

Hypothesis 6: Person-Organization Fit mediates the relationship between ethical climate and ethical decision-making intentions.

Hypothesis 7: Person-Organization Fit mediates the relationship between digital competence and ethical decision-making intentions.

Moderating role of organizational digital ethical culture and educational level

Organizational digital ethical culture encompasses the shared norms, values, and practices within a bank that guide employees in making ethical decisions in the digital sphere (Shin et al. 2023; Zhanbayev et al. 2023). This culture emphasizes not only the importance of ethical behavior but also the integration of digital literacy and ethical considerations into daily operations. In Chinese commercial banks, where digital transformation is a priority, a robust digital ethical culture can act as a significant moderator between P-O Fit and employees’ ethical decision-making intentions.

Employees with a high level of P-O Fit are generally more inclined to internalize the bank’s ethical standards and values (Alqhaiwi et al. 2024). However, the strength of this relationship can be influenced by the digital ethical culture of the organization. When this culture actively promotes ethical conduct in digital contexts, it amplifies the positive effect of P-O Fit on employees’ ethical decision-making intentions. In contrast, a weak or absent digital ethical culture may hinder ethical behavior, even among employees with strong organizational fit, as they may lack clear guidance on handling ethical dilemmas in digital settings (Ashok et al. 2022).

Empirical studies support this moderating effect. Lobschat et al. (2021) found that a strong organizational culture—especially one that prioritizes ethics and digital responsibility—can significantly enhance employee ethical behavior. Similarly, Delecraz et al. (2022) underscored the importance of ethical digital cultures in fostering trust and transparency among employees, which further strengthens ethical decision-making. Therefore:

Hypothesis 8: Organizational Digital Ethical Culture moderates the relationship between person-organization fit and ethical decision-making intentions.

Educational level is another critical factor that can moderate the relationship between P-O Fit and ethical decision-making intentions in Chinese commercial banks. Employees with higher educational attainments often possess advanced cognitive skills, critical thinking abilities, and a broader understanding of ethical principles (Abulibdeh et al. 2024). These attributes can enhance their capacity to make ethical decisions, especially in complex digital environments.

When combined with a high level of P-O Fit, educational attainment can amplify the positive influence on ethical decision-making intentions. Highly educated employees who are well-aligned with their organization’s values are more likely to draw on their knowledge and skills to make ethical judgments that align with the bank’s ethical framework (Masood et al. 2024). Conversely, employees with lower educational levels may face challenges in navigating ethical dilemmas, especially in the digital realm, which can weaken the impact of P-O Fit on their decision-making processes (Fig. 1).

Empirical evidence supports the moderating role of educational level. Studies such as Chen et al. (2021) and others have shown that educational attainment is positively correlated with ethical judgment and decision-making capabilities. Similarly, Small and Lew (2021) indicated that employees with higher levels of education tend to exhibit stronger ethical behavior and compliance with organizational policies. Therefore:

Hypothesis 9: Educational level moderates the relationship between person-organization fit and ethical decision-making intentions.