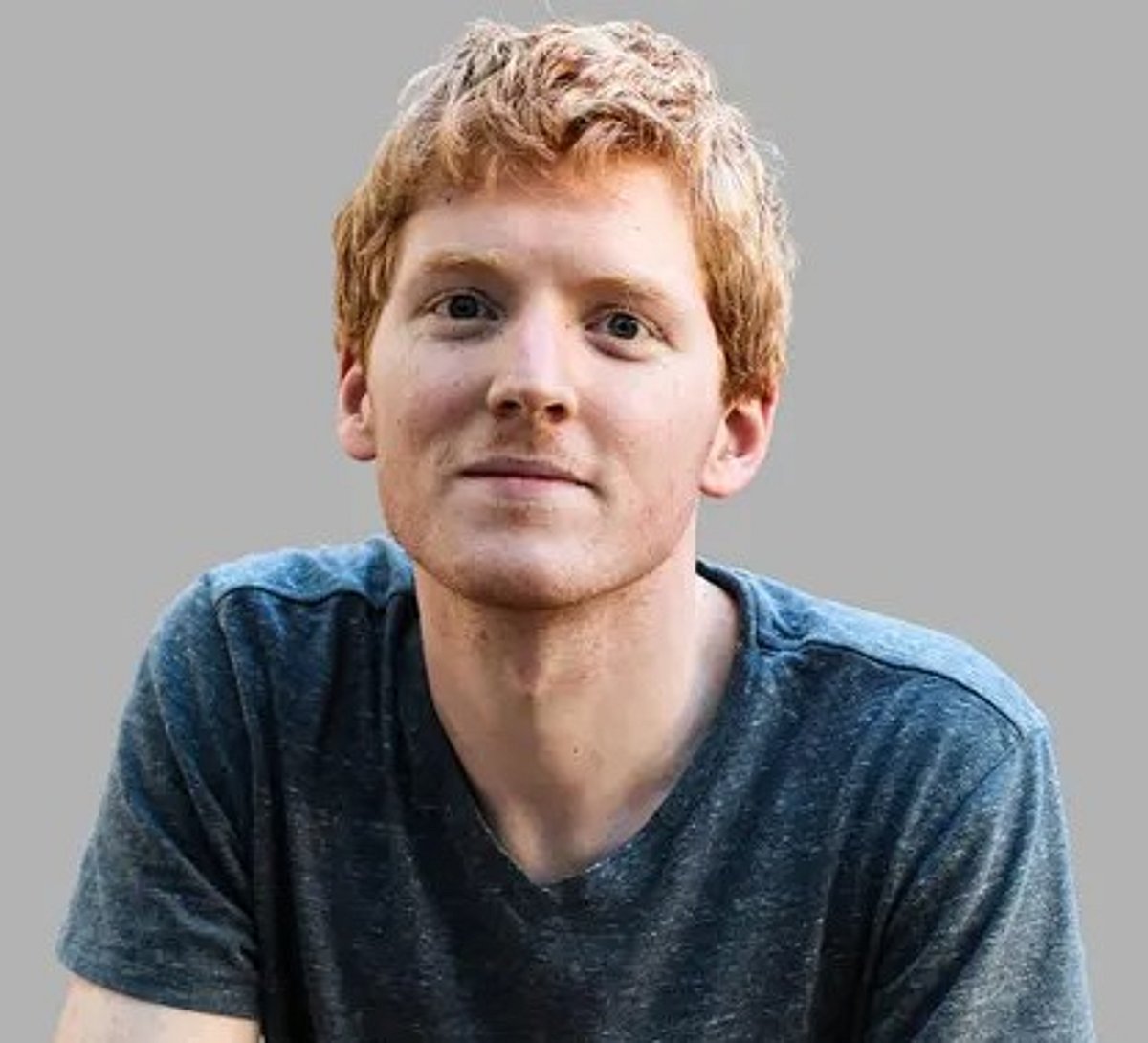

A college dropout who turned questions into a trillion-dollar Stripe

From small town to big time

Born in a small town in Ireland, Patrick began coding before most kids even had email.

By 16, he’d won Ireland’s top science prize for designing an AI programming language.

College? He gave MIT a try — then dropped out to start building businesses with his younger brother, John.

Seven lines of code

The brothers’ big idea?

Make payments on the internet as easy as embedding a YouTube video.

In 2010, they launched Stripe with just seven lines of code, aiming to make online payments effortless for developers and businesses alike.

That clean, powerful API (application programming interface) became their secret sauce — no bloated platforms, no endless setup.

Stripe: Not just payments

Today, Stripe is far more than a payment processor.

It offers billing tools, tax automation, fraud protection, identity verification, and even carbon removal tools.

It’s basically a fintech Swiss Army knife used by everyone from Ford and Amazon to Shopify and Spotify.

Stripe doesn’t just handle payments — it helps build entire online businesses.

Tech royalty on speed dial

From day one, Stripe attracted Silicon Valley’s A-list.

Elon Musk and tech money guru Peter Thiel were early investors, and the startup quickly earned street credibility among developers and founders alike.

Stripe spoke their language — literally.

Its tools were built by coders for coders, winning love from the startup crowd all the way to enterprise giants.

Slaying the PayPal giant

Stripe didn’t just grow — it exploded.

While PayPal (once Confinity, later merged with Musk’s X.com) was the original GOAT of online payments, Stripe arrived with sleek code, instant integration, and a “let’s build the internet” attitude.

PayPal paved the road, but Stripe built a superhighway on top of it.

Today, Stripe handles over $1.4 trillion in annual payment volume and is valued at $95 billion — with some estimates valuing it as high as $115 billion.

Patrick, the college dropout, has been consulted by the US Congress, specifically on the consequences of a US Central Bank Digital Currency.

Growth goes global

Stripe now operates in more than 195 countries, supports 135 currencies, and powers millions of businesses — from startups in Lagos to tech unicorns in Silicon Valley.

Its growth in 2024 alone? Up 38% year-over-year. His personal networth? $10.1 billion, per Forbes.

From millionaire teen to trillion-dollar visionary

Before Stripe, Patrick and John sold their first startup, Auctomatic, for several million dollars — and they were barely out of their teens.

Stripe was the real breakthrough, and under Patrick’s leadership, it grew into one of the most powerful forces in global commerce.

Stripe’s API became the gold standard.

And Patrick became one of the wealthiest — and most respected — founders in tech, with an estimated personal net worth of $10.1 billion, as per Forbes (mid-2025).

Outsider advantage

Here’s the twist: Patrick wasn’t a finance guy.

He didn’t grow up studying banking. He was an outsider — and that’s exactly what gave him the edge.

He questioned the status quo. Found shortcuts others couldn’t. Built what people actually needed. And once Stripe started to scale, he made sure the world knew just how powerful that vision could be.

Still just getting started

Stripe, too, is expanding into areas like marketplaces, card issuing, and global economic infrastructure.

What started with seven lines of code is now a platform powering much of the global internet economy.

Patrick’s rise isn’t just a startup success story. It’s a blueprint for building smart, asking why, and never settling for “that’s how it’s always been done.”

Stripe didn’t follow the rules. It rewrote them.