CareerBuilder + Monster files for Chapter 11 bankruptcy

Profstonge.com economist Peter St Onge discusses why Americans are suddenly dropping out of the labor force on ‘Making Money.’

Online job listing company CareerBuilder + Monster filed for Chapter 11 bankruptcy protection on Tuesday.

The Chicago-based company, formed by the September merger of CareerBuilding and Monster, said it agreed to sell its job board operations, its most recognizable business, to JobGet, which has an app for so-called gig workers.

Monster, the older of the two, “has worked to transform the recruiting industry” for 30 years, its website said. CareerBuilder has been in business for over 20 years, according to its website.

“For over 25 years, we have been a proud global leader in helping job seekers and companies connect and empower employment across the globe,” Jeff Furman, CEO of CareerBuilder + Monster, said in a statement.

AMAZON CEO SAYS AI WILL REDUCE HIS COMPANY’S WORKFORCE

A “Now Hiring” sign sits next to the Jiffy Lube booth during the Mega JobNewsUSA South Florida Job Fair held in the Amerant Bank Arena on April 30, 2025 in Sunrise, Florida. (Joe Raedle / Getty Images)

“However, like many others in the industry, our business has been affected by a challenging and uncertain macroeconomic environment. In light of these conditions, we ran a robust sale process and carefully evaluated all available options. We determined that initiating this court-supervised sale process is the best path toward maximizing the value of our businesses and preserving jobs.”

CareerBuilder + Monster, currently owned by private equity firm Apollo Global Management and Dutch staffing company Randstad, also agreed to sell its software services business for federal and state governments to Canadian software company Valsoft, and the military.com and fastweb.com websites to Canadian media company Valnet.

FED CHAIR POWELL SAYS US ECONOMY IN A ‘SOLID POSITION’

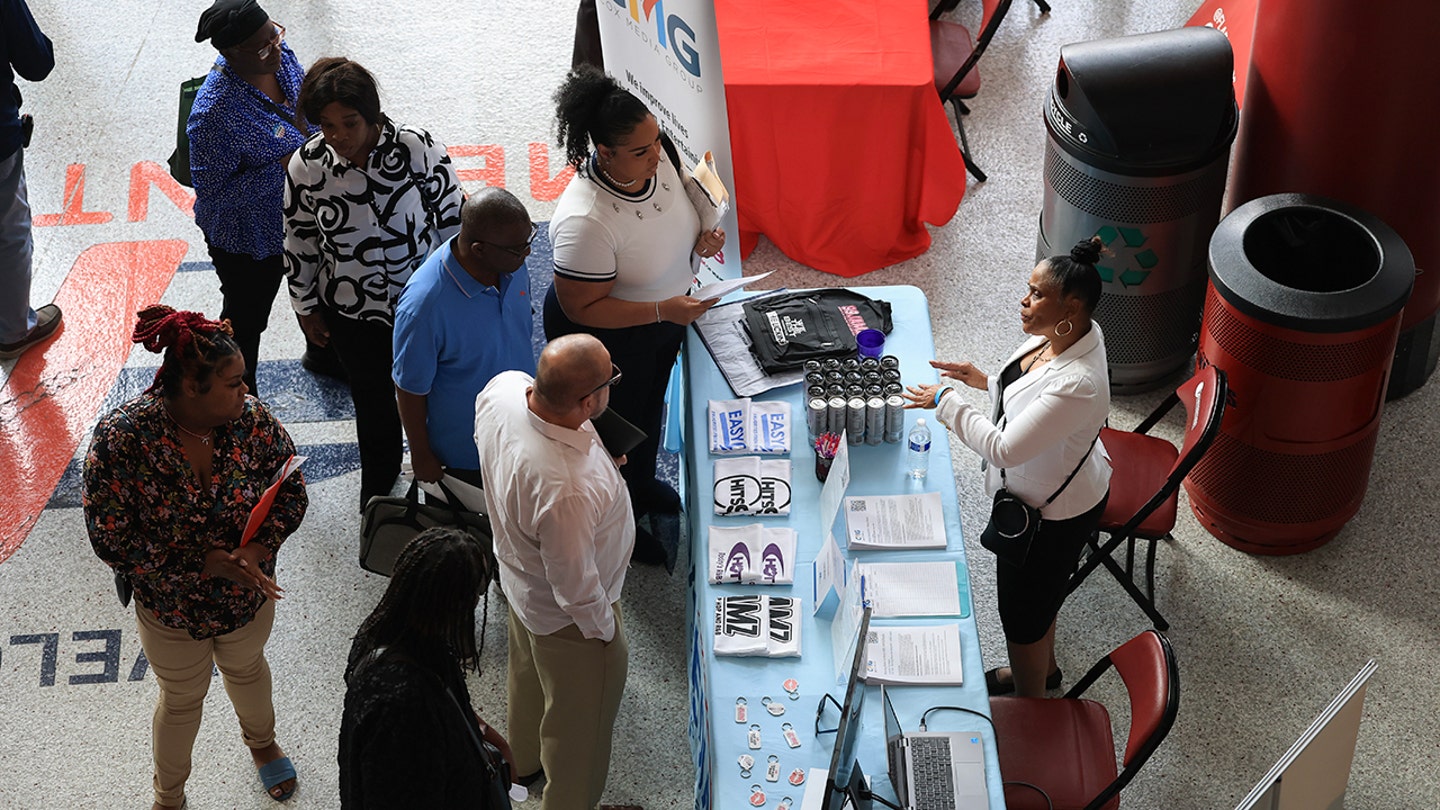

People visit the Cox Media booth at the Mega JobNewsUSA South Florida Job Fair held in the Amerant Bank Arena on April 30, 2025 in Sunrise, Florida. (Joe Raedle / Getty Images)

The buyers agreed to act as “stalking horse” bidders, with sales subject to better offers. The terms were not disclosed.

The bankruptcy was filed in the district of Delaware. The filing, obtained by FOX Business, estimates the company’s assets as between $50-100 million, with estimated liabilities at $100-500 million.

Mitch Graham, center, inquires about jobs at Triton Recovery during the Mega JobNewsUSA South Florida Job Fair held in the Amerant Bank Arena on April 30, 2025 in Sunrise, Florida. (Joe Raedle / Getty Images)

The company is lining up $20 million of financing to keep operating in bankruptcy.

The company has struggled with competition from other job platforms, including aggregators and social media websites such as LinkedIn, according to published reports.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| APO.N | NO DATA AVAILABLE | – | – | – |

| RAND.AS | NO DATA AVAILABLE | – | – | – |

CLICK HERE TO READ MORE ON FOX BUSINESS

Reuters contributed to this report.