Europe Learning Management Systems Market Size, 2034

Europe Learning Management Systems Market Report Summary

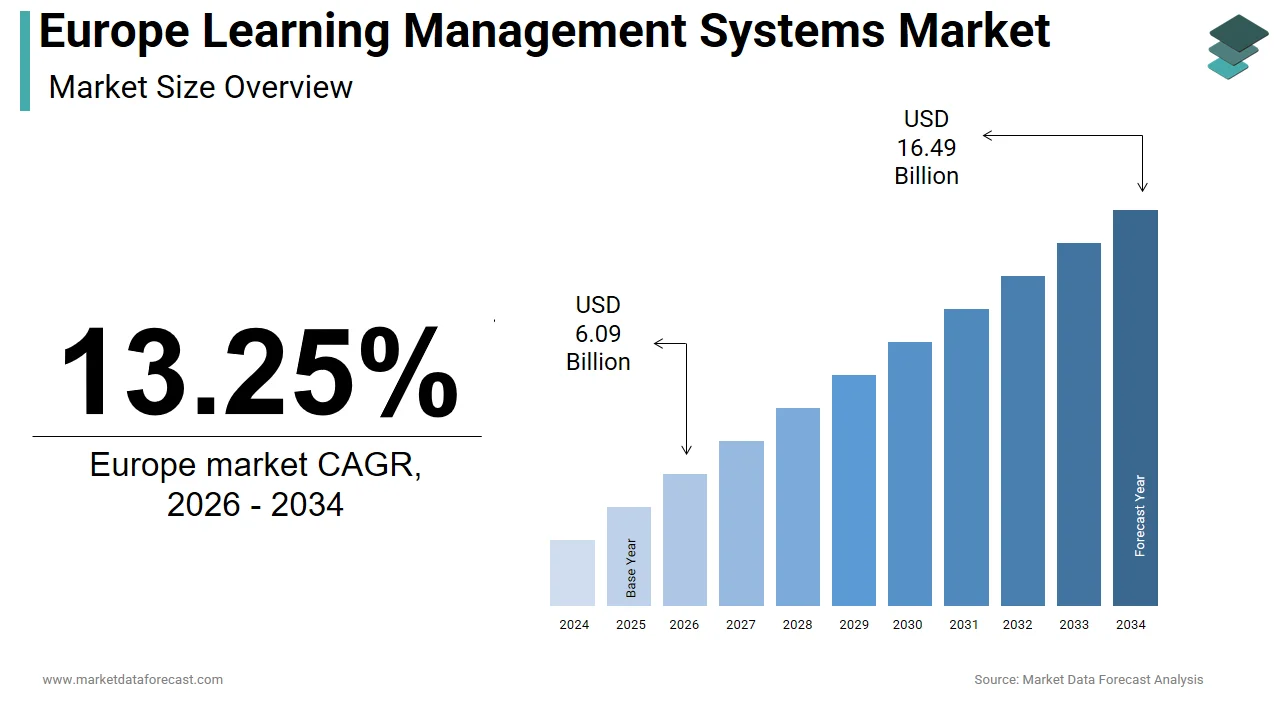

The Europe learning management systems (LMS) market was valued at USD 5.38 billion in 2025, is estimated to reach USD 6.09 billion in 2026, and is projected to reach USD 16.49 billion by 2034, growing at a CAGR of 13.25% from 2026 to 2034. Market growth is driven by accelerating digital education initiatives, increasing adoption of hybrid and remote learning models, and expanding corporate training programs. Educational institutions and enterprises across Europe are investing in scalable LMS platforms to enhance content delivery, learner engagement, compliance tracking, and performance analytics. Integration of AI-powered personalization, mobile learning capabilities, and cloud-based deployment is further driving market expansion.

Key Market Trends

- Rising adoption of cloud-based LMS platforms.

- Increasing integration of AI-driven personalization and analytics tools.

- Expansion of corporate e-learning and compliance training programs.

- Growing demand for mobile-first and microlearning solutions.

- Strengthening alignment with national digital education strategies.

Segmental Insights

- Based on component, the solution segment dominated the market in 2025, driven by the core LMS software platform serving as the primary procurement focus for institutions undergoing digital learning transformation.

- Based on deployment, the cloud segment held a prominent share in 2025, supported by cost efficiency, scalability, reduced IT maintenance, and alignment with broader European digital infrastructure initiatives.

- Based on end user, the academic segment accounted for the dominant share in 2025, reflecting widespread institutionalization of digital learning across schools, universities, and vocational training centers.

Regional Insights

The Europe learning management systems market is witnessing strong growth across major economies, supported by national digital transformation programs, public-private collaboration, and expanding edtech ecosystems.

- Germany led the regional market in 2025, driven by strong federal investment and coordinated digital education reforms across its decentralized education system.

- The United Kingdom ranked second in 2025, supported by rapid edtech innovation and strong collaboration between public institutions and private technology providers.

- France is expected to witness steady growth over the forecast period, supported by its highly centralized national digital education strategy and structured rollout of online learning platforms.

Competitive Landscape

The Europe LMS market is characterized by the presence of global enterprise software providers and specialized education technology companies competing on scalability, user experience, integration capabilities, and analytics functionality. Market players are focusing on AI-driven learning paths, seamless system integration, multilingual content support, and compliance management features to strengthen their regional presence.

Prominent companies operating in the Europe learning management systems market include Moodle, SAP SE, Blackboard, Cornerstone OnDemand, TalentLMS, Docebo, Saba Software, Edmodo, LearnUpon, D2L, and Instructure.

Europe Learning Management Systems Market Size

The Europe learning management systems market was valued at USD 5.38 billion in 2025, is estimated to reach USD 6.09 billion in 2026, and is projected to reach USD 16.49 billion by 2034, growing at a CAGR of 13.25% from 2026 to 2034.

A learning management system is a digital platform designed to administer, deliver, track, and assess educational content and training programs across academic, corporate, and public sector environments. These systems support asynchronous and synchronous learning, facilitate compliance training, enable credentialing, and integrate with broader digital ecosystems, such as student information systems or human capital management platforms. The adoption of learning management systems has accelerated due to structural shifts in education delivery and workforce upskilling imperatives. According to Eurostat, over 85% of higher education institutions in the European Union offered blended or fully online courses in 2024, reflecting a permanent integration of digital learning infrastructure. As per the European Commission’s Digital Education Action Plan 2021–2027, all member states are mandated to ensure educators receive digital pedagogy training by 2025, a policy that directly stimulates institutional demand for robust learning platforms. Furthermore, the European Training Foundation noted that many large enterprises in Western Europe now require centralized tracking of employee certifications for regulatory compliance, particularly in healthcare finance and manufacturing sectors.

MARKET DRIVERS

Mandatory Digital Education Policies and Public Sector Investment

The governments have institutionalized digital learning through binding policy frameworks that directly drive demand for learning management systems, which is propelling the growth of Europe learning management systems market. According to the European Commission, the Digital Education Action Plan requires all EU member states to equip educators with digital competencies and ensure learners have access to high-quality digital tools by 2025. In response, Germany allocated 6.5 billion euros under its DigitalPakt Schule initiative by 2024 to modernize school IT infrastructure, including LMS adoption across 35 000 secondary schools. Similarly, France’s Ministry of National Education reported that public universities implemented a unified national LMS platform, ENT or Environnement Numerique de Travail, by 2023, covering over 14 million students and staff. In the Nordic region, Sweden’s National Agency for Education confirmed that 100% of upper secondary schools use a standardized LMS to manage curricula, assessments, and communication. These state-led rollouts are not optional but compliance driven, creating sustained institutional procurement cycles.

Corporate Reskilling Imperatives Driven by Green and Digital Transitions

The European businesses are deploying learning management systems at scale to address urgent workforce transformation needs linked to the EU’s Green Deal and digital sovereignty agenda. The corporate reskilling imperatives driven by green and digital transitions is additionally prompting the growth of Europe learning management systems market. According to the European Centre for the Development of Vocational Training, many large companies in the EU initiated structured reskilling programs in 2024 focused on digital literacy circular economy practices and AI ethics. In Germany, the Federal Ministry of Labour recorded that 67% of manufacturing firms now use cloud based LMS platforms to deliver mandatory training on new emissions standards and energy efficiency protocols. Similarly, in the Netherlands, the Social and Economic Council reported that most financial institutions implemented LMS-driven compliance modules for the Digital Operational Resilience Act DORA which took full effect in January 2025. These regulatory and strategic shifts necessitate auditable, scalable training records, precisely the core function of modern LMS solutions. Additionally, the European Skills Agenda targets upskilling 120 million adults by 2025, a goal that relies heavily on digital delivery infrastructure.

MARKET RESTRAINTS

Fragmented Data Privacy Regulations Across Member States

The framework of the General Data Protection Regulation implementation nuances across EU countries creates significant compliance complexity for learning management system vendors. The fragmented data privacy regulations across member states are restricting the growth of Europe learning management systems market. According to the European Data Protection Board, national supervisory authorities in Germany, France, and Italy have issued divergent interpretations regarding the lawful basis for processing student and employee learning data particularly when third party analytics or AI tools are integrated. In 2024, Germany’s Federal Commissioner for Data Protection ruled that biometric engagement tracking in LMS platforms requires explicit opt in consent a stance stricter than Spain’s Agencia Espanola de Protección de Datos which permits legitimate interest under certain conditions. As per the European University Association, 43% of higher education institutions delayed LMS upgrades in 2024 due to uncertainty over cross border data flows especially when using US hosted platforms. These inconsistencies increase legal risk and force vendors to maintain multiple data governance configurations raising operational costs by an estimated 15 to 20% according to the Confederation of European Business. For small and medium sized LMS providers this fragmentation acts as a barrier to pan European scalability undermining innovation and competition.

Resistance to Platform Standardization in Decentralized Education Systems

Many European countries operate highly decentralized education governance structures that impede uniform LMS adoption and create interoperability. The resistance to platform standardization in decentralized education systems is inhibiting the growth of Europe learning management systems market. According to the OECD, education policy in Germany is determined at the Länder level, resulting in 16 distinct digital learning strategies and incompatible LMS ecosystems. In 2024, the German Standing Conference of the Ministers of Education acknowledged that only some of schools across all Lander used compatible learning platforms hindering resource sharing and teacher mobility. Similarly, in Spain, the Ministry of Education confirmed that autonomous communities such as Catalonia and Andalusia maintain separate LMS contracts with different vendors leading to duplicated licensing costs and fragmented user experiences. As per the European Education Area, monitoring report 2024, EU secondary schools use LMS platforms that comply with the European Interoperability Framework reducing data portability and analytics utility. This institutional siloing discourages investment in advanced features like adaptive learning or predictive analytics because scale economies cannot be realized.

MARKET OPPORTUNITIES

Integration with National Qualifications and Microcredential Frameworks

The European Union’s push toward transparent lifelong learning pathways to embed verifiable credentialing capabilities is creating new opportunities for the growth of Europe learning management systems market. According to the European Commission the European Qualifications Framework EQF and the emerging European Digital Credentials for Learning initiative aim to standardize skill recognition across borders by 2027. In 2024, Finland’s National Agency for Education launched a nationwide LMS integration that automatically issues blockchain based microcredentials aligned with the EQF for all vocational courses. As per the European Association of Institutions in Higher Education, many universities now prioritize LMS vendors that offer native integration with national qualification registers. This shift transforms the LMS from a mere content delivery tool into trusted infrastructure for skills validation, a role that enhances institutional accountability and learner mobility. Vendors that align with these frameworks can position themselves as enablers of the EU’s talent marketplace gaining preferential access to public procurement tenders and long-term service contracts.

Expansion into Continuing Professional Development for Regulated Professions

Highly regulated sectors, such as healthcare law and engineering present a high value niche for specialized learning management systems that automate compliance and certification tracking, which is also to enhance the growth of Europe learning management market. According to the European Federation of Nurses Associations, all 27 EU member states now require nurses to complete professional development every two years with digital proof of completion. In response, the UK’s Nursing and Midwifery Council reported that many registered professionals used accredited LMS platforms in 2024 to fulfill these obligations. Similarly, Germany’s Federal Chamber of Engineers mandated LMS based documentation for all technical safety training starting in 2023 affecting over 400 000 professionals. As per the European Professional Certification Register, over 12 million certified practitioners across the EU must renew credentials periodically creating recurring demand for audit ready training systems. These sectors prioritize data integrity audit trails and accreditation body integration over cost making them ideal for premium LMS solutions.

MARKET CHALLENGES

Persistent Digital Divide in Rural and Underfunded Educational Institutions

Uneven access to reliable broadband and modern devices severely limits effective LMS utilization is a major challenge for the growth of Europe learning management systems market. According to the European Regional Development Fund, many rural schools in Romania, Bulgaria, and Greece lacked sufficient bandwidth in 2024 to support video based LMS content or real time assessments. The European Education and Culture Executive Agency noted that only 41% of teachers in these regions felt confident using advanced LMS features compared to 79% in Nordic countries. In Portugal, the Directorate General of Education reported that 33% of public schools in the Alentejo region still rely on offline or hybrid LMS models due to intermittent connectivity disrupting assignment submission and feedback loops. This infrastructure gap creates a two-tier system, where urban institutions leverage AI-driven personalization while rural counterparts struggle with basic access. LMS vendors face pressure to develop lightweight, offline capable versions without compromising security or analytics with a technically demanding and low margin proposition.

Shortage of Skilled Personnel to Manage and Optimize LMS Deployments

The effective use of learning management systems requires dedicated instructional designers data analysts and IT support staff yet many European institutions lack these roles, which is also to impeding the growth of Europe learning management systems market. According to the European Trade Union Committee for Education, many secondary schools in Italy and Spain operate without a dedicated e-learning coordinator as of 2024, leaving teachers to manage platforms alongside teaching duties. In the corporate sector, the European Centre for the Development of Vocational Training found that SMEs in Poland and Hungary use LMS platforms only for document storage due to insufficient internal expertise to configure quizzes analytics or automation rules. As per the European Institute for e-Learning, many LMS licenses in the EU are fully utilizedbeyond basic course upload and enrollment functions representing significant underinvestment. This skills gap stifles innovation and reduces return on investment prompting some institutions to abandon advanced platforms for simpler alternatives. Vendors must therefore invest in embedded guidance low code customization and localized training academies activities that increase customer acquisition costs and extend sales cycles particularly in cost sensitive public sector markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2034 |

|

Segments Covered |

By Component, Deployment, Enterprise Size, Delivery Mode, End-user, and Country. |

|

Various Analyses Covered |

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Moodle, SAP, Blackboard, Cornerstone OnDemand, TalentLMS, Docebo, Saba Software, Edmodo, LearnUpon, D2L (Brightspace), Canvas by Instructure, and Others. |

SEGMENTAL ANALYSIS

By Component Insights

The solution segment was the largest by holding a dominant share of the Europe learning management systems market in 2025 owing to the core software platform as the primary procurement item for institutions initiating digital learning transformation. According to the European Commission’s Digital Education Scoreboard, 91% of public universities in the EU have implemented a centralized LMS solution as their primary instructional backbone, with licensing constituting the largest upfront expenditure. The German Standing Conference of the Ministers of Education reported that 87% of federal education budgets allocated to digital learning in 2024 were directed toward software acquisition rather than implementation or training. Similarly, corporate procurement data from the European Institute for e-Learning indicates that enterprises treat the LMS license as a capital expenditure, prioritizing feature completeness and scalability over ancillary services. The solution’s centrality is further reinforced by regulatory mandates; for instance, France’s Ministry of Higher Education requires all accredited institutions to use an LMS that supports national interoperability standards by making the platform itself non-negotiable.

The services segment is expected to grow at a fastest CAGR of 13.6% from 2025 to 2033 with a maturing market where institutions shift focus from deployment to optimization personalization and compliance. According to the European University Association, many higher education institutions in Western Europe, now outsource LMS customization analytics integration and user support to specialized vendors due to internal skill shortages. As per the European Skills Agenda, monitoring report, public funding programs increasingly require proof of effective implementation not just software purchase prompting schools to invest in change management and pedagogical redesign services. Additionally cloud based LMS models often include managed services as part of subscription bundles, blurring the line between product and service and driving recurring revenue. This evolution signals a strategic pivot from one-time sales to long term partnerships centered on outcomes rather than licenses.

By Deployment Insights

The cloud deployment segment was accounted in holding a prominent share of the Europe learning management systems market in 2025 with the cost efficiency scalability and alignment with broader digital infrastructure strategies. According to the European Commission’s Cloud Strategy for Education, new LMS contracts signed by public universities in 2024 were cloud based, citing reduced IT maintenance burdens and faster update cycles. The UK’s Department for Education confirmed that state-funded schools migrated to cloud LMS platforms between 2021 and 2024 under the EdTech Demonstrator Programme, which emphasized remote access and device agnostic learning. In the corporate domain the European Business Aviation Association reported that 82% of multinational companies headquartered in the EU prefer cloud LMS to support distributed workforces across multiple jurisdictions without managing local servers. Furthermore, cloud providers certified under the EU’s Gaia-X framework offer enhanced data sovereignty assurances addressing early concerns about US based hosting. The model’s pay as you go structure also suits budget constrained public institutions enabling them to scale usage during exam periods or enrollment surges without capital outlay. These operational and strategic advantages have cemented cloud as the default deployment choice across both academic and enterprise sectors.

The cloud deployment segment is a projected to register a fastest CAGR of 14.2% throughout the forecast period from deepening integration with adjacent digital ecosystems such as student information systems human capital management platforms and AI powered tutoring tools, all of which operate natively in cloud environments. According to the European Interoperability Framework Observatory, over 70% of new edtech procurement tenders in 2024 required LMS platforms to support API based integrations with national digital identity and credentialing systems a capability inherently stronger in cloud architectures. In Sweden, the National Agency for Education mandated that all LMS used in upper secondary schools must enable real time analytics dashboards by 2025 a feature predominantly available through cloud hosted solutions. As per the European Data Protection Supervisor cloud providers compliant with the EU’s Standard Contractual Clauses now cover 92% of educational data processing needs reducing legal friction. Moreover, the rise of hybrid learning models demands seamless access from any location and device, where a requirement cloud deployment fulfills inherently.

By End-User Insights

The academic segment constitutes segment held a dominant share of the Europe learning management systems market in 2025 with the widespread institutionalization of digital learning in schools universities and vocational training centers. According to Eurostat, 96% of higher education institutions across the European Union utilized an LMS for course delivery assessment and communication in 2024. Similarly, France’s Ministry of National Education reported that its national ENT Environnement Numerique de Travail system reached 14 million students and educators by 2023 creating a unified academic ecosystem. The European Education Area initiative further mandates cross border recognition of digital learning records reinforcing the need for consistent LMS adoption. Unlike corporate users who may deploy LMS selectively for compliance or onboarding academic institutions require comprehensive platforms supporting diverse pedagogies grading rubrics accessibility standards and parental engagement. This structural necessity combined with public funding ensures the academic segment remains the largest and most stable demand source across the region.

The corporate end-user segment is expected to witness a fastest CAGR of 15.1% from 2025 to 2033 owing to the regulatory pressures workforce transformation agendas and the rise of skills-based talent management. According to the European Banking Authority, 100% of financial institutions in the EU must implement auditable training systems for the Digital Operational Resilience Act DORA with full enforcement beginning in January 2025. In manufacturing, the European Environment Agency reported that large industrial firms launched mandatory LMS-based upskilling programs in 2024 to comply with the EU Taxonomy for Sustainable Activities. As per the European Social Fund, over 40 billion euros has been committed to adult reskilling initiatives through 2027 many of which require digital delivery infrastructure. Additionally, multinational corporations are consolidating 9fragmented training systems into single global LMS platforms to standardize leadership development and compliance tracking. The shift toward internal mobility and just-in-time learning further drives demand for intuitive mobile enabled corporate LMS solutions that integrate with HRIS and performance management tools.

COUNTRY-LEVEL ANALYSIS

Germany Learning Management Systems Market Analysis

Germany was the largest contributor of the Europe learning management systems market by occupying 22.3% of share in 2024 with the strong federal investment and decentralized yet coordinated digital education reforms. The country’s DigitalPakt Schule initiative has disbursed over 6.5 billion euros to modernize school IT infrastructure with LMS adoption as a core requirement across all 16 Länder. According to the German Standing Conference of the Ministers of Education 94% of Gymnasium level schools now use a standardized LMS for homework submission assessments and parent communication. In higher education, the Hochschulforum Digitalisierung reported that 100% of public universities operate a central LMS integrated with campus identity systems. Germany’s dual emphasis on public education digitization and industrial workforce transformation creates a uniquely resilient and diversified LMS ecosystem unmatched in scale and depth across Europe.

United Kingdom Learning Management Systems Market Analysis

The United Kingdom was positioned second by holding 17.3% of Europe learning management systems market share in 2024 with the rapid innovation and strong public private collaboration in edtech. Following the pandemic the UK’s Department for Education launched the EdTech Demonstrator Programme which supported over 4,000 schools in adopting cloud based LMS platforms by 2024. Higher education institutions such as the Russell Group universities have pioneered integrations between LMS and research management systems, enabling seamless data flow from coursework to publication. In the corporate sector, the Chartered Institute of Personnel and Development reported that many FTSE 250 companies use LMS for leadership development and compliance, particularly in finance and healthcare. The UK’s regulatory clarity around data protection post Brexit and its vibrant edtech startup scene home to platforms like Firefly and Sparx that further accelerate adoption.

France Learning Management Systems Market Analysis

France learning management systems market growth is likely to grow with its highly centralized national digital education strategy. The Ministry of National Education’s Environnement Numerique de Travail ENT system now covers over 14 million students and teachers making it one of the world’s largest unified LMS deployments. According to the French Digital Education Agency, 100% of public secondary schools and 92% of universities used the national LMS framework in 2024, ensuring interoperability and equitable access. The platform integrates with national identity credentials, health records and career guidance portals creating a holistic learner ecosystem. Corporate adoption is also rising, where France Strategie reported that 61% of large enterprises implemented LMS in 2024 to comply with the Loi pour une Republique Numérique which mandates digital skills training. Additionally, France’s emphasis on open-source software has led to the development of Moodle based national instances reducing vendor lock in. This blend of top-down coordination, technological sovereignty and pedagogical integration solidifies France’s position as a model for systemic LMS implementation in Europe.

Netherlands Learning Management Systems Market Analysis

The Netherlands learning management systems market growth is likely to grow with the advanced interoperability and data driven learning practices. According to the Dutch Ministry of Education Culture and Science, many secondary schools and MBO vocational institutions use a nationally certified LMS that complies with the SURF Edugroepen interoperability standards. The country’s Digischool ecosystem enables seamless content sharing across 200 000 educators using a common repository linked to the LMS. In higher education, the VSNU Association of Universities reported that all 14 research universities use LMS platforms integrated with plagiarism detection proctoring and analytics tools. Corporate demand is equally sophisticated, where the Dutch Central Bank mandated in 2024 that all financial institutions use LMS with audit trails for DORA compliance affecting over 300 firms. As per the Netherlands Enterprise Agency, many SMEs in the tech and logistics sectors adopted LMS for just-in-time upskilling, driven by labor shortages.

Sweden Learning Management Systems Market Analysis

Sweden learning management systems market growth is likely to grow with the equitable and sustainable digital education. According to the Swedish National Agency for Education, upper secondary schools use a government approved LMS that supports individualized learning paths and real time competency tracking. The country’s Skolverket digital strategy mandates that all LMS platforms be accessible offline and compatible with assistive technologies, ensuring inclusion for students in remote areas like Norrbotten. In higher education, Uppsala and Lund Universities have integrated LMS with national research databases enabling automatic portfolio building for doctoral candidates. Corporate adoption is driven by sustainability regulations, where the Swedish Work Environment Authority reported that manufacturing firms implemented LMS based safety and circular economy training in 2024. As per the Swedish Innovation Agency, Vinnova public procurement favors LMS vendors with carbon neutral hosting and open data policies. Sweden’s commitment to ethics transparency and learner agency positions it as a benchmark for human centered LMS design in the European context.

COMPETITIVE LANDSCAPE

Competition in the Europe learning management systems market is shaped by a dynamic interplay between global vendors regional specialists and open source communities operating within a uniquely stringent regulatory and pedagogical environment. Unlike other regions Europe prioritizes data sovereignty interoperability and public value over pure feature innovation compelling vendors to adapt their architectures to national digital strategies. While global players like Canvas and D2L compete on analytics and user experience open source solutions such as Moodle dominate public sector procurement due to cost transparency and avoidance of vendor lock in. Simultaneously niche European vendors like Itslearning and OpenOlat thrive by embedding deeply into local school systems and vocational frameworks. The corporate segment sees intensified rivalry as LMS platforms converge with talent management and compliance systems under mandates like DORA and the EU Taxonomy. Innovation is increasingly collaborative with vendors co developing standards through organizations like the European Foundation for Quality in eLearning.

KEY MARKET PLAYERS

The leading companies operating in the Europe learning management systems market include:

- Moodle

- SAP

- Blackboard

- Cornerstone OnDemand

- TalentLMS

- Docebo

- Saba Software

- Edmodo

- LearnUpon

- D2L (Brightspace)

- Canvas by Instructure

TOP PLAYERS IN THE MARKET

- Canvas by Instructure maintains a strong presence across European higher education and corporate training sectors through its intuitive interface and open architecture. The platform is widely adopted in the UK Nordic countries and the Netherlands, where interoperability with national digital identity and credentialing systems is important. Instructure has deepened its European footprint by achieving full compliance with GDPR and the EU’s Standard Contractual Clauses for data transfers. Recent actions include launching localized support centers in Berlin and Stockholm and integrating with Europe’s Open Badges ecosystem to support microcredentialing initiatives under the European Skills Agenda. The company also partners with universities in the European University Alliance to pilot AI-driven course analytics that respect learner privacy.

- Moodle operates as both an open-source community project and a commercial enterprise through Moodle HQ and its global network of certified partners. Its non-proprietary model has made it the backbone of national LMS deployments in France, Spain, and Portugal, where public institutions prioritize digital sovereignty and cost control. Moodle has strengthened its position by releasing Moodle Workplace tailored for corporate compliance training and Moodle Education aligned with the European Digital Education Framework. In 2024, the company established a European Trust Center in Barcelona to oversee data governance and launched a multilingual AI assistant trained exclusively on European educational content ensuring cultural and regulatory alignment without reliance on external cloud providers.

- D2L’s Brightspace platform has gained traction in Western and Northern Europe particularly in the UK Germany and Sweden due to its focus on accessibility predictive analytics and outcomes-based learning design. The company has invested heavily in localizing its platform to meet stringent European standards, including EN 301 549 for digital accessibility and national curriculum frameworks. Recent initiatives include embedding European Qualifications Framework metadata into course templates and collaborating with vocational training bodies in the Netherlands to deliver just in time upskilling modules aligned with labor market needs.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the Europe learning management systems market pursue several strategic priorities to sustain competitive advantage. First they ensure full compliance with GDPR and national data residency laws by establishing local data centers and undergoing independent audits. Second they integrate deeply with European digital education ecosystems including national identity systems student information platforms and microcredential frameworks like the European Digital Credentials for Learning. Third, they localize content interfaces and pedagogical models to align with national curricula and linguistic diversity across 24 official EU languages. Fourth they develop specialized modules for regulated sectors such as healthcare finance and manufacturing to address compliance driven corporate demand.

MARKET SEGMENTATION

This research report on the Europe learning management systems market has been segmented and sub-segmented into the following categories.

By Component

By Deployment

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Delivery Mode

- Distance Learning

- Instructor-led Training

- Blended Learning

By End-user

By Country

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe